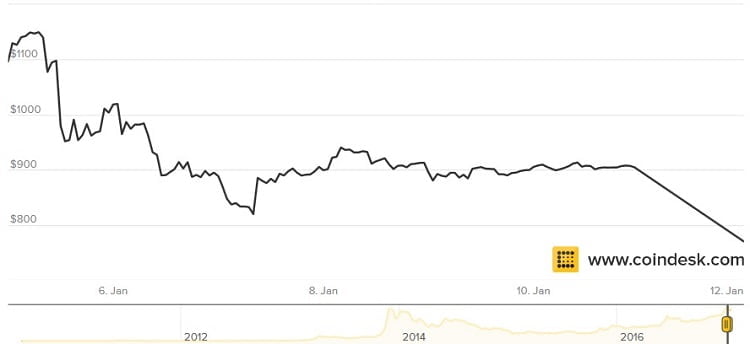

To say that bitcoin investors are having a rough time over the past few days would be a gross understatement. Over the trailing week, bitcoin prices have run the gamut of challenging all-time records to suffering extreme bouts of volatility. And it’s not just about the bitcoin collapse — the popular digital currency has endured several series of sharp selloffs, primarily at a time when most Americans are sound asleep.

That trading dynamic brings us to a logical conclusion. Whoever or whatever entity is inducing the bearishness, the culprit may likely be from the Asian markets. After all, their equity markets begin trading a few hour after the closing bell at the New York Stock Exchange. Although that doesn’t preclude American involvement — or some other locale — the timing of the trades does arouse suspicion.

This isn’t merely conjecture. Earlier today, China’s central bank said “it had launched spot investigations on bitcoin exchanges in Beijing and Shanghai in order to fend off market risks.” The focus of the investigation centers on “possible market manipulation, money laundering, unauthorized financing and other issues,” according to information compiled by Reuters.

During the course of these events, bitcoin prices fell from $909 on the Europe-based Bitstamp exchange to $861, or a drop of nearly 5%. However, since the disclosure of the China investigation, another bitcoin collapse ensued, driving the price below the $780 threshold. That’s more than an additional 9% loss on top of the aforementioned 5%.

Naturally, the question becomes, when will the bitcoin collapse cease? Seeing as how the $780 mark was roughly the price range prior to its multi-year record rally, you would expect this present range to be where bitcoin prices stabilize. I also think it’s more than a little bit coincidental that the mainstream hawked bitcoin as “the new gold” just prior to its fallout.

If there were market manipulation or other factors besides free market forces involved in the bitcoin collapse, it wouldn’t surprise me. Bitcoin represents true freedom, the ability for anybody to trade from anywhere at any time they so wish to choose — all that is required is an internet connection. There is no centralized mandate controlling bitcoin and digital currencies, and because of that, no government control or taxation.

That’s the central reason why so many bankers and major financial institutions fear bitcoin. It might upend the undisputed hegemony of the financial system by getting rid of unnecessary middlemen. Make no mistake about it — bitcoin and digital currencies conflict with the bankers’ core interests.

Simply put, there’s more than enough incentive to engineer a bitcoin collapse.