Is Bitcoin Digital Gold?

When you think of Gold, what do you think of? Wealth, power, money? For thousands of years, mankind has used gold as a means of value to measure merchandise against in order to buy & sell.

In the last 50 years, we have seen Gold increase in its value, slowly but surely it has become more expensive. There was a time when all currencies were backed by some form of wealth, historically Silver or Gold.

The Nixon Shock Changed Gold Forever!

With a fiat based currency backed by a form of wealth, it gave savers, investors and consumers a chance to have real wealth in every pay check. Most importantly, it gave confidence in the long term future for workers.

Gold’s huge but slow trend gained momentum when in Aug 1971, President Nixon unhinged the dollar from being backed by Gold — this is now called “the Nixon Shock”.

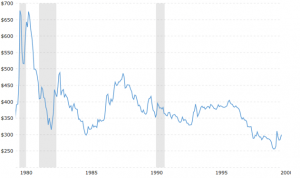

The precious metal moves slowly over the next decade from $35-$40 all the way to $875 in January 1980, a sign of rampant inflation and a weakening currency, great for those who stocked up on Gold in the earlier years.

Refer below to the chart from macrotrends.net to see the huge but steady rise in Gold.

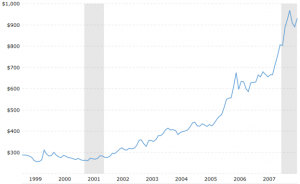

Fast forward around thirty years the world is very different, the dotcom bubble happened and technology and money have surged in capacity.

Inflation has run wild and recessions seem to be a regular occurrence, each decade brings more bad news as fiat money worldwide takes a nose dive.

People’s faith in their own local currencies is at an all-time low and people want a solution… Here enters Bitcoin!

Since its creation in 2009, people have looked at Bitcoin as a safe-haven and a store of value similar to Gold. There are noticeable similarities, as it is based on supply & demand. There is a limited supply/amount thus making it harder and more valuable to buy as it continues to grow.

The main difference is that Bitcoin is made of innovation, cutting edge technology, and digital algorithms and numbers while Gold is made of solid metal and comes from the Earth itself.

People began to dub Bitcoin as Gold.2 and Digital Gold, a very grand title for something so young and volatile!

They share many similarities!

When Gold is discovered in the Earth, it is usually achieved through mining,

Hard work (digging) produces the rewards of more gold (if they find it) for supply,

However with Bitcoin, people set up their computers to perform complicated algorithms (digital digging) and the reward is a certain amount of Bitcoin. Because the process has a similar logic to finding Gold, it has also been called mining!

Banks simply print out more money at their leisure!

Like Gold as more Bitcoin are mined the harder it gets and the difficulty goes up. The mining rewards of Bitcoin that miners receive actually halve every four years (halving events). The most recent halving was in July 2016, the next is in 2020.

As only 21 Million Bitcoin will ever be mined, this gives Bitcoin a very similar logic to Gold in terms of Supply & Demand.

What Are The Pros & Cons?

Gold Pros:

- Physical metal you can hold.

- Based on supply & demand, certain amount in existence.

- Timeless it has been used as a base currency since ancient times.

- It is proven to increase in value in uncertain times of war or geo political turmoil.

- Store of value and proven stable price.

Gold Cons:

- Hard to move around or transport quickly.

- Difficult to use to buy bread & milk with, manipulated markets.

- Easily Stolen.

Bitcoin Pros:

- Only 21 million will be mined, supply and demand based.

- Innovative and proven to be a good investment.

- Store it on most devices e.g. memory stick, laptops, offline devices.

- Can be moved cross border easy and bought in tiny amounts.

- Almost private.

- Secure peer to peer transactions to avoid tampering.

- The software can be upgraded and upscale for mainstream adoption.

Bitcoin Cons:

- Volatile price movement.

- Easily lost.

- Exchanges can be hacked and cause price to drop sharply.

- Not mainstream yet

Everything has good and bad points, being able to understand them all will always help in understanding these two commodities/currencies overall.

So do they behave in the same manner?…

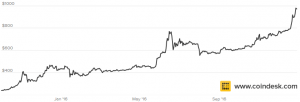

As this Bitcoin chart from Coindesk.com shows Bitcoins movement and behaviour looks very similar to the Gold surge after the Nixon Shock!

Could Bitcoin be doing in one year what Gold did in the space of ten years or could it be just a random coincidence?

After both these forms of wealth had their surge/bubble they have a very similar cool off period, Gold on one hand was much slower and stable over the course of twenty years while Bitcoins was in the space of around 1 – 2 years!

Let’s take a look below at these charts from Coindesk & Macrotrends.

Gold above shows after its surge it needed a cool down period which lasted twenty years,

Bitcoin is below shows it needed its cool down period from its all-time high for around 24 – 48 months!.

The Upward Trends

From around the late 1990s, we see below that Gold starts to recover and increase its value over the period of ten years leading up to the financial crash of 2008 – 2011 plus events like 9/11, the second gulf war and Afghanistan provided instability in the markets.

As 2015 came to a close and 2016 began Bitcoin also behaved in a similar pattern (just much more faster) in an upward trend, again events in the geo political scene had a influence; Unstable Central Banks, Brexit, Donald Trump, Russia, China & again the Middle East.

See Bitcoin’s upward trend below.

What Does This Mean?

Although this is all speculative, if correct then it shows Gold & Bitcoin move very similar, with the difference of what Gold does in movement and behaviour in a decade Bitcoin does in the space of around one year.

Their prices and volatility maybe different, but the overall market behaviour seems similar, it just moves at different speeds.

To truly know the answer and whether Bitcoin is truly Digital Gold, then we need to give Bitcoin more time, that’s the logical approach to take.

But for the question of Bitcoin being a safe, stable store of value…

It is losing its volatility and less shaky than the pound sterling! Its innovation and cutting edge technology is still in its infancy, if we are to compare Bitcoin and the overall technology (blockchain) to something I would say it is now where the public internet was in the early 1990s!

In conclusion, to this I would say Bitcoin is absolutely a store of value, a great savvy alternative to precious metals, its market capital is at an all-time high at the moment and more and more people are starting to use Bitcoin and its alternatives every day.

As a technology it could bring more than just being a currency or a digital version of Gold giving it larger room for growth in the long-term.

Gold I would also say is a great way to defend your wealth against banker made recessions and depressions. It’s proven itself time & time again and has a proven track record of stability.

The key is to diversify ones wealth and never put everything in one basket, always make your decisions based on sound logic and research.