All four precious metals sold off quite hard today. Gold traded -2.5% lower today at $1252, silver was down 7% to $16.80 during the trading session, platinum fell by 3.5% and palladium by 3.2%. It was only a week ago that gold’s rallying surpassed $1,300 per ounce.

Is there anything concerning about today’s sell off?

We would not raise a red flag yet. However, we believe that this situation deserves a yellow flag. As we have explained in the last couple of weeks, there are several bullish factors for the metals but there are also some concerns. Gold’s safe haven appeal has been appreciated by the market in the first weeks of 2015. With a consolidation in the U.S. stock markets, pointing to a potential top formation (although not confirmed yet), the Swiss National Bank unpegging its currency from the euro, and increased volatility in the market, investors have been on the buy side in the metals market.

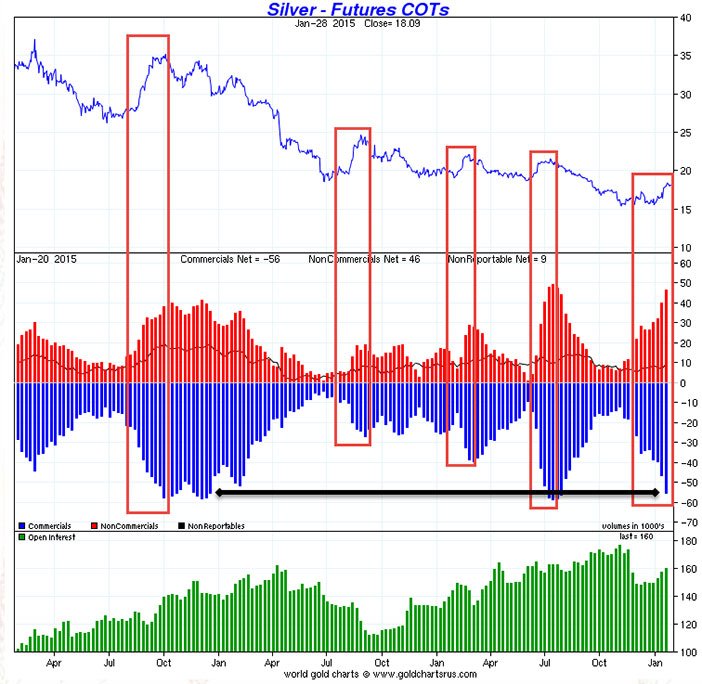

On the other hand, deflationary pressures are too visible to be ignored, as evidenced by a monstrous rally in the U.S. dollar and crashing crude oil and copper prices. Another reason for concern, and maybe the most important one, is the change of positions in the COT reports. Let us explain this based on below charts.

Gold And Silver Commitment Of Traders Reports

The positions of large traders in COMEX gold and silver, as reported by the Commitment of Traders report (COT), have changed quickly in the last couple of weeks. The first chart below shows the current positions of commercials and non-commercial traders in the gold market with the blue and red bars (center of the chart). Those two are the key participants in COMEX.

The key takeaway of the report is the pace of change of the short positions of commercials during each price rally, as marked by the red rectangles. The faster the commercials accumulate short positions during a price rally, the higher the chance that the rally will be short-lived.

The change of the commercial shorts relative to the gold price rally of the last couple of weeks has been remarkable. Commercial shorts are at the highest level since February 2013. Their stopping power has become clear in today’s price decline.

Even more concerning is the silver COT report. The second chart shows futures positions in COMEX silver. It is the same chart setup as the one in gold. The pace at which commercials have accumulated short positions in a matter of weeks is almost astonishing. It is very similar to the situation of last summer, when the metals started to rally in their seasonally best months (July / August), but were abruptly stopped. The pace at which commercials had added shorts positions was very similar to January 2015.

Going forward, readers should closely watch the price of gold; the yellow metals should hold above $1,250, a huge support level which also coincides with the 200 day moving average (approximately). If gold were to fall below that level, it would not bode well for the metals in the short and intermediate term.

Chart courtesy: Sharelynx.