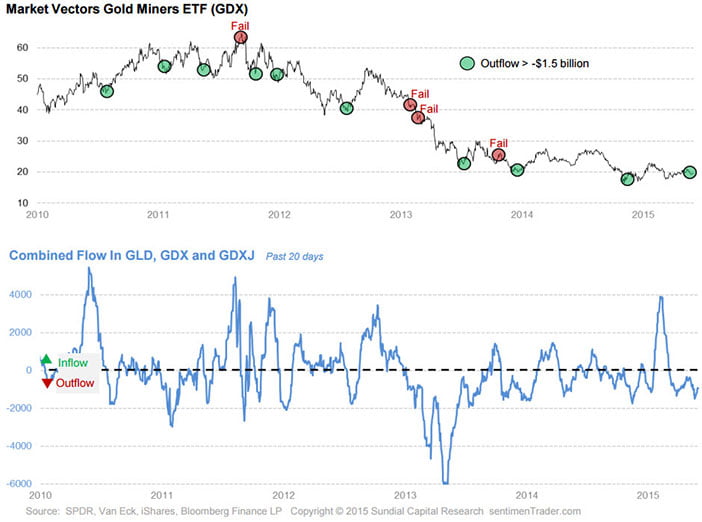

In May, there was quite an outflow from gold-related funds like GLD, GDX and GDXJ. More than $1.5 billion left those funds, which is one of the largest in the past five years.

The chart below shows the combined flow from those three gold-related funds, compared to the price of the gold miners fund, GDX.

The chart indicates that there were a few failures, but mostly when the outflow got this large, it was a contrary signal for GDX, and gold miners tended to rally from such an exodus.

Sentimentrader notes that, of the 14 times that the combined flow in those fund exceeded –$1.5 billion, GDX rallied over the next 1-3 months 10 times, and failed to see any upside 4 times. “It just recently exceeded that threshold again, suggesting a higher probability of a rally than a failure.”

A Decade Opportunity

The disinterest in gold related investments is a sign that weak hands are leaving the market. That is a good indicator. It implies that no sellers are left, and smart buyers could do their thing. To us, it means that the bottom in gold and silver is either very close or already a fact. We do not exclude one last final decline which would create a washout bottom. If that were to happen, investors should use that once-in-a-decade opportunity.