Statistical Reasons Why Forecasting Major Indices Is A Huge Pain

The heavy sell-off that occurred across global financial markets on Friday, April 17, may be the culmination of poor economic fundamentals, at least amongst financial experts who have long argued against the “fake” bull market of Western equity benchmarks. More logical than conspiratorial, the basis for the argument is that economic recovery is engineered through currency and interest rate manipulation. With some balance, a small adjustment in monetary policy can be beneficial but the rampant exercise of quantitative easing that we are witnessing in the U.S., Europe and Japan may intractably ransom future generations’ prosperity. Should investors then regard the market’s latest development as a harbinger?

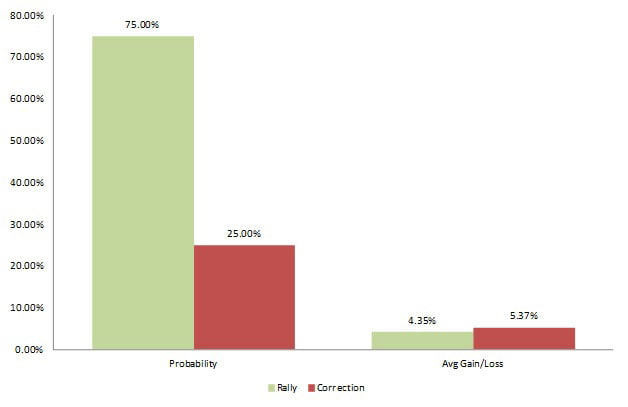

In some ways, yes, and in others, no. As frustrating as such a duplicitous answer can be, let’s explore some facts. Over the past 90 days, the benchmark S&P 500 (INDEXSP:.INX) has an average performance of 1.85%. Given similar occurrences in a long history dating back to the 1950s, there is a 75% probability that the U.S. markets will move higher by mid-July of this year.

Up, Up and Away

What is not so clear is how bankable such a strong probability would normally imply. Average market returns for a quarterly performance of 1.85% is +4.35%, whereas average losses amount to -5.37%. Quite simply, the magnitude of risk is over 23% higher than the magnitude of reward. This is quite unfavorable for most investors. Typically, a call made from statistical analyses will look for a combination of strong upside probabilities and strong market returns. One without the other renders the call speculative. In the case of the U.S. equities sector, it has to be acknowledged that elements of volatility are beginning to creep into the system.

Consider the relationship between the S&P 500’s price action and its market returns one quarter later. While the point tally on the benchmark index continues to build upon one record-breaking threshold upon another, average market returns have generally offered lesser profitability. That means that the S&P’s technical price patterns is becoming more predictable — up, up and away! — but where it matters most — ie. returns for the investor — the index is failing to impress.

This sets up a unique and hugely problematic issue for large-capitalization indices. On a day-to-day level, a financial advisor can confidently direct their clients towards an allocation heavy in blue-chip stocks knowing that the major equity indices will slowly crawl their way up. However, on the off-chance that they are wrong, each bum moment carries a higher leverage and extracts a greater impact than the collection of times when the market moves favorably.

The end result of this granularity is that the bears are gaining a foothold in the markets. We just don’t know when exactly they’ll strike.