The airlines industry has been making headlines in financial and business news, most of it for completely bearish reasons. A pronounced example is the U.S. Global Jets ETF (AMEX:JETS), as of now the only exchanged-traded fund that tracks the performance of publicly traded airline companies. It’s a very recent concoction, with its initial opening having occurred in May of this year, and should recent trends continue in the markets, the ride would be a very quick one.

Since closing at $24.78 on its inaugural session, JETS quickly collapsed a few weeks later, touching 22-even on multiple intra-day occasions before settling at $22.78 on Friday, June 19. Losing 8% of market valuation in less than two months of existence is a sure-fire way to lose both current and prospective investors, threatening what little volume remains in this Wall Street train-wreck. Unless something fundamentally important were to shift — and shift now! — JETS is on the fast-track to becoming a zombie-ETF, a pejorative label given to funds that no longer are viable opportunities due to a lack of interest.

So Bad, It’s Good!

The signs could not be more discouraging. Late last week, renowned investment advisory firm Zacks Equity Research downgraded discount-leader Southwest Airlines (NYSE:LUV) to its lowest rating, equivalent to a “strong sell.” Such ratings are not given flippantly. The nature of Wall Street analysts is that they are biased to the upside: for better or for worse, many companies “buy” or otherwise incentivize positive ratings from popular stock analysts. The practice is legally questionable and completely unethical, but it does occur. So for a popular Big Board stock to dubiously earn a strong sell, well…it’s the market equivalent of a Raspberry Award: so bad, it’s good!

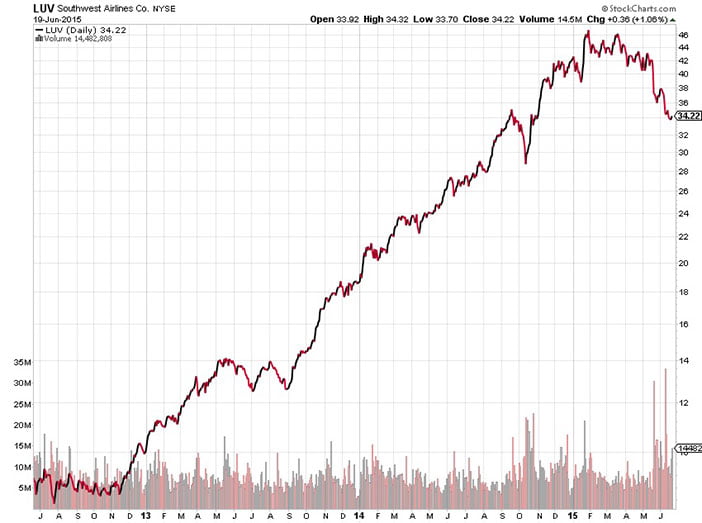

The entirety of blame should not be leveled upon Southwest’s management team but the writing — at least from a technical perspective — was on the wall. This is a company that from the beginning of 2013 until the peak of 2015 returned over 326% gains! Even with the recent correction that has rocked Southwest and other airliners — in particular, discount competitors like Spirit Airlines (SAVE) and JetBlue (JBLU) — LUV stock is still up over 200% from January 2013.

In response to their rapid rise, Southwest amped up its internal forecasts. Wall Street was all too happy to play along and both new and veteran investors enjoyed the benefits. However, with fissures beginning to show in the so-called economic recovery — specifically in consumer spending and confidence — the ever-lofty forecasts could no longer be justified.

And in the fickle environment of the New York Stock Exchange, it really is as simple as that. Investors are absorbing heavy losses and don’t see much technical reasons to continue on with the pain. On the fundamental side, Zacks’ downgrade provides the bears with every reason in the world to short the living snot out of LUV stock.

Until this bloody inevitability rides its course, conservative investors should steer clear of Southwest and most airliners in general.