As the cusp of a new year draws near and tax-loss harvesting gets under way, it’s a great time to refresh our income-producing portfolios and consider accumulating shares of dividend outperformers and overachievers. This class of stocks is known for consistent growth and for rewarding shareholders with regular dividend payments irrespective of macroeconomic conditions.

The challenge lies in identifying dividend yielders that are solid companies but aren’t overpriced – a tall order in a market that’s been running hot for a full year now. To save you the time and trouble, I’ve sifted through a heap of stocks and plucked out a few dividend aristocrats that might be worth adding to your watch list or even your portfolio.

Clorox (CLX)

More than just a bleach company, Clorox offers an array of products with name-brand status: Liquid Plumr, Pine-Sol, Tilex, Fresh Step, Hidden Valley, KC Masterpiece, Kingsford… I’ll bet you didn’t know that those are all Clorox brands. I’ll also bet you didn’t know that Clorox beat fiscal first-quarter earnings expectations with $1.59 per share versus the analyst consensus estimate of $1.54 per share.

Courtesy: Clorox Investor Presentation

Clorox stock offers a solid 2.87% dividend yield and its 52-week range is $143.58 to $167.54; as of this writing, the shares are trading much closer to the bottom than the top. With a P/E ratio of 23.52, CLX provides good value along with the decent dividend payouts – a nice bonus for income-focused investors.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

Genuine Parts Company (GPC)

A true dividend king is a company that raises its dividend payouts for many consecutive quarters, and Genuine Parts Company definitely fits that definition. This automotive replacement parts distributor has been around since 1928 and has raised its dividend payments for 63 years without interruption.

Speaking of dividends, the 2.97% annual yield offered by Genuine Parts Company should impress income seekers of all stripes. In 2019 the company generated nearly $20 billion in revenues and the stock is trading at a low P/E ratio of 19, so I think you’ll find a genuine bargain with Genuine Parts Company.

Leggett & Platt (LEG)

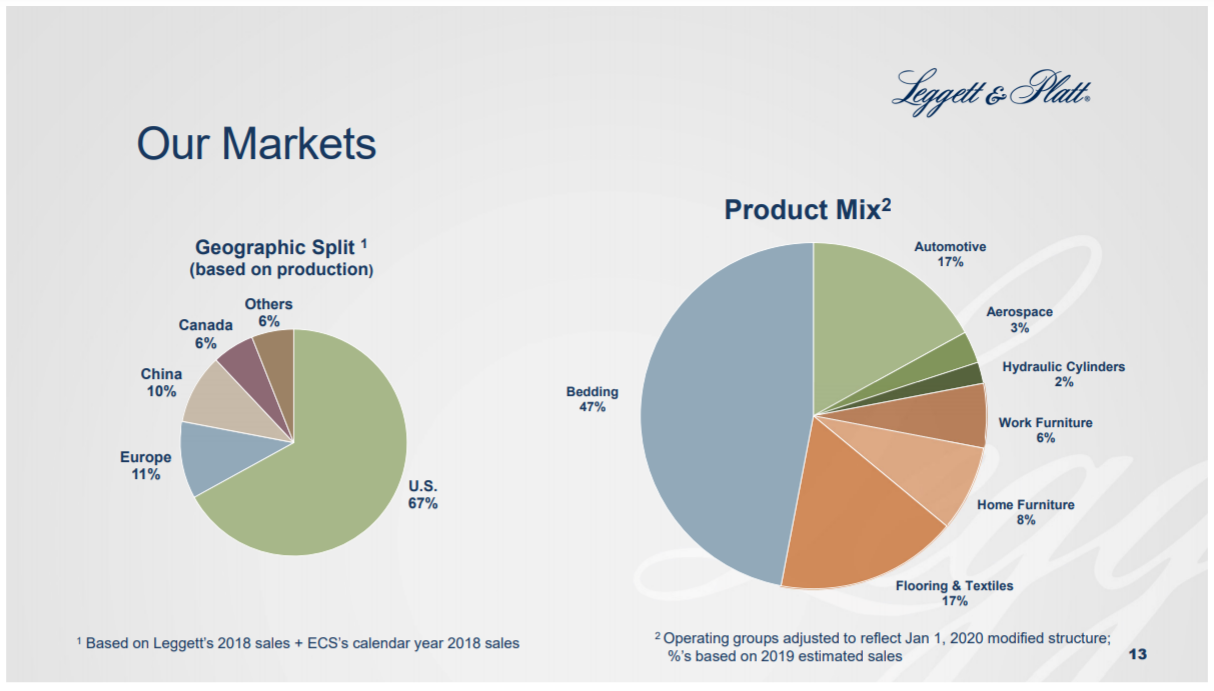

Leggett & Platt is one of those companies that you’ve never heard of but you’ve probably used their products without knowing it. Known in the industry primarily a bedding and furniture company, Leggett & Platt is also involved in the automotive, flooring, and textiles segments, among others.

A target of 6% to 9% annual revenue growth and a three-year (2016-2019) sales CAGR of 8.2% suggest a company with well-deserved confidence and ambition. Moreover, LEG’s P/E ratio is a reasonable 23.31 and the forward dividend yield of 3.09% are the markings of a dividend king worth a look.

Archer Daniels Midland (ADM)

Agriculture giant Archer Daniels Midland has operations in nearly 200 countries and generates annual revenues in excess of $64 billion – suffice it to say that this one’s a powerhouse in the industry. Furthermore, Archer Daniels Midland reported third-quarter 2019 adjusted earnings per share of $0.77, handily beating the analyst consensus estimate of $0.69.

This company has been paying dividends for 87 years and has increased its dividend payouts for more than 40 years, so there’s no question that Archer Daniels Midland has earned its designation as a dividend king. Meanwhile, a moderate P/E ratio of 20.56 and a robust forward dividend yield of 3.26% strike a balance between strong value and steady returns for ADM stock.

Dividend investing is a simple way to cushion your portfolio with a little bit of extra income while you ride out the ups and downs of the market. With patience and due diligence, you can build wealth over time and outperform the vast majority of retail traders – indeed, you can invest with pride when you’ve got the dividend kings on your side.

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!