The situation across Europe has changed considerably since penning Part 1, 2, and 3 (Twitter thread) in September of last year. Any positive outcomes since the fall are likely short-lived amidst a bigger picture taking shape that’s detrimental to Europe’s economy, and the socioeconomic consequences are difficult to foresee with any certainty since war rhetoric in support of Ukraine has only escalated. There’s serious concern about recession taking hold in Europe, the economic impact of deindustrialization, and the possible shutdown of BASF in Germany or permanent cost cuts in its European operations. The latest update on NATO’s proxy war with Russia was published last week in Part XII (thread) of the “Little Green Men” series. Let’s begin with excerpts from the last Dark Age article:

“Verbose responses from NATO and U.S. officialdom sound delusionary, panicked, and desperate… ‘Putin denied using energy as a ‘weapon’ and defended the decision this week to indefinitely shut the key Nord Stream natural-gas pipeline to Europe as a consequence of European sanctions’… The industrial base in Europe is taking a brutal beating that will severely impact everything that originates in the manufacturing sector, including jobs, consumer products, base metals, and the energy grid… The founder and Director of Research at Energy Aspects, Amrita Sen, set the record straight last week about any debate over oil markets vs. Europe’s energy crisis: ‘It’s not a one winter story, let’s just make it very, very clear’… Western sanctions that target Russia backfired on the West’s economy by launching an energy crisis that worsened inflation pressures, heightened food insecurity on the heels of Great Reset greenie policies, and the Federal Reserve’s monetary tightening accelerated recessionary conditions in Europe. Some folks get it, but a majority of politicos and zombie peasants appear clueless or bought off by Klaus Schwab’s WEF promises of a Borg utopia.” – TraderStef, Sep. 2022

Who used energy as a weapon while declaring economic war against its allies and declaring war on Russia? Circumstantial evidence points to sabotage by the United States (Biden’s directive) and Norway for blowing up Russia’s Nord Stream gas pipelines to Germany beneath the Baltic Sea on Sep. 26. Results of an investigation conducted by Sweden conceded that “the blasts were an act of sabotage” but refused to release its findings to civilian plebes or Moscow. Coincidentally, the Baltic Pipe was inaugurated with an opening ceremony in Goleniów, Poland, on Sep. 27.

Alongside those Nord Stream pipelines, the Baltic Pipe was under construction since 2014, which extends from energy producer Norway to the Norwegian shelf via Denmark and through the Baltic Sea to Poland. The Baltic Pipe’s export capacity is 10 billion cubic meters (bcm) of gas annually to Poland (roughly 15% of its annual consumption) and it transports 3 bcm of gas from Poland to Denmark, which began in Oct. 2022. In comparison, Nord Stream’s twin pipeline capacity was 55 bcm annually with significantly cheaper Russian gas for Europe’s energy infrastructure and manufacturing needs to support its economy. U.S. LNG shipped to Europe to offset shortages due to sanctions on Russian energy costs up to 6x more for the retail consumer. The following two graphics are courtesy of a chartbook via Bruegel.

France’s mainstream media wants to blame Europe’s energy costs on U.S. suppliers, but reality dictates that poor energy policy over decades and the sanctions against Russia in 2022 precipitated the current situation.

Price of gas: Why does Europe pay much more than U.S.? – France24, Dec. 1

The rush to fill European LNG facilities in 2022 filled their storage tanks to 95% of capacity by Nov. 2022, well above an 80% target the European Commission set in March. Building out domestic infrastructure for additional LNG import and storage capacity to meet demand will not be realized until at least 2030. Despite the mild winter weather thus far and success in reducing gas consumption across the European continent this year, the energy crisis is far from over as Amrita Sen noted back in September. Beginning in Mar. 2023, European utilities must start refilling inventories again to prepare for next winter without the reduced Russian supply they had starting in mid-2022. The share of E.U. energy imports from Russia in 2021 accounted for 26% of crude oil, 52% of coal, and 52% of natural gas. The total imports of Russian gas into Europe were estimated at 60 bcm last year.

Germany Still Years Away From Replacing Russian Gas Capacity… “It will take until 2026 for Germany to install 56 billion cubic meters of domestic LNG import capacity, about the same it imported by pipe from Russia in 2021, the Economy Ministry wrote in an answer to a set of questions by the Left Party. By 2030 those capacities are seen at 76.5 billion cubic meters, or about 80% of total German gas consumption in 2021.” – Bloomberg, Jan. 2023

Costs for energy are likely to remain elevated for Europe in the foreseeable future because reconciliation with Russia is unlikely in the current geopolitical atmosphere. Additionally, there’s increased demand in the global economy that’s reopening after pandemic lockdowns, stiff competition for the available supply as LNG is estimated to increase by only 20 bcm worldwide in 2023, and China is expected to absorb 85% of that new supply while reducing reexported supplies to Europe. UAE oil producers also expressed concern over an oil supply shortage for export by 2024, and Russia plans deep oil export cuts up to 25% beginning next month. The LNG supply gap Europe is expected to face this summer is roughly 30 bcm, which is half of what’s needed to fill its storage capacity to 95% before next winter.

European energy utilities will continue paying elevated prices for imports despite the recent price correction in U.S. natural gas, and some governments have implemented financial support and price caps on what consumers and small businesses can be charged. That dynamic will result in more utility and/or energy companies requiring a bailout to stay afloat and continued government support for consumers ($600 billion to date) so they can afford the extraordinary electricity and gas bills. The greenie utopia will not save Europe anytime soon as German electrical equipment giant Siemens lost $1 billion in 4Q22 on alternative energy projects and Germany’s renewable energy power grid is unable to power a zero-carbon green society. There’s also a return to coal as energy security and a growing pro-nuclear energy alliance across Europe as the energy crisis trumps climate goals.

IEA chief warns that next winter will be tougher for EU… “due to the ‘gas crisis,’ said International Energy Agency Executive Director Fatih Birol… ‘I commended the EU’s efforts to overcome the gas crisis this winter, but next winter will be even tougher. A new masterplan for European industry is urgently needed.’ European governments use expensive liquefied natural gas, delivered by sea from the United States and Qatar, to compensate for their gas deficit.” – TASS, Feb. 17

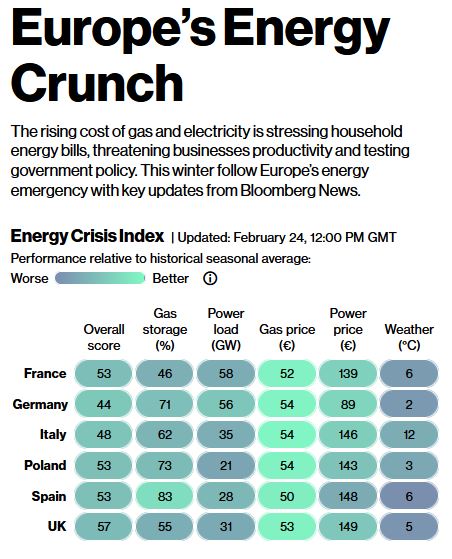

Europe’s Energy Crunch – Bloomberg, Feb. 24, 2023

Along with the rising cost of energy, central banks’ monetary policy in the West are fighting an inflation monster by raising interest rates into a recessionary economy, in turn forcing consumers and businesses to spend less, which reduces the amount of tax revenue generated. The amount of financial support that’s required to provide relief to everyone from the “energy shock” in Europe is not there since governments cannot keep increasing sovereign debt and printing more currency, which will only worsen the inflation dynamic and risk a surge in European defaults on sovereign debt.

Europe’s Coming Bond Avalanche Will Test the ECB… “European governments are set to unleash a deluge of bonds into markets this year. Investors will demand either a further shift higher in yields or a substantial improvement in the region’s inflation outlook to digest the coming wave of supply, adding to the already daunting monetary policy challenges facing the European Central Bank. The 10 largest euro nations are expected to sell some €1.3 trillion ($1.38 trillion) of sovereign bonds this year. A little over half of that will be new money, after allowing for maturing debt. It’s a scarily large jump in net new supply of around €340 billion… Someone, somewhere is going to have to step up and buy all of these new securities. Unfortunately, the timing is poor as central banks globally have become net sellers of the holdings they accumulated in the wake of the global financial crisis and to fund stimulus measures to address the pandemic… The risk is clearly rising of a policy error. The memory is still raw of the interest rate hikes a decade ago by the Jean-Claude Trichet-led ECB, which triggered the euro crisis. Lagarde needs to step carefully in raising rates too sharply, as well as withdrawing central bank liquidity at the same time. European governments need the money — but there is a limit to what they can realistically afford to pay to finance their burgeoning debt burdens.” – Bloomberg, Jan. 6

EU Inflation Less Energy New Record / Overall CPI 2nd Worst Ever – Wolf Richter

UK grocery price inflation surges to record 16.7%… “British grocery inflation hit a record 16.7% in the four weeks to Jan. 22, dealing another blow to consumers battling an escalating cost-of-living crisis, industry data showed on Tuesday. Market researcher Kantar said grocery inflation was at its highest since it started tracking the figure in 2008, with prices rising fastest for essential products such as milk, butter, cheese, eggs, dog food and toilet rolls.” – Reuters, Jan. 31

Swiss Inflation Quickens After Jump in Consumers’ Power Bills… “Inflation in Switzerland accelerated more than economists forecast, a result that may add to Swiss National Bank concerns about cost pressures getting out of control.” – Bloomberg, Feb. 13

City of London to make skyscrapers dim their lights at night… “Under the proposal from the City of London Corporation, property owners across the Square Mile – a 1.12 square mile zone in the center of the capital whose boundaries stretch from the Temple to the Tower of London and from Chancery Lane to Liverpool Street – would be asked to switch off unnecessary building lights. City officials are concerned about energy wastage and light pollution.” – The Guardian, Feb. 11

Meanwhile, asymmetrical food shortages are popping up across Europe, such as vegetables vanishing from UK supermarket chains last week. Media commentators have expressed their disdain with government messaging that appears to be prepping folks for more rationing and sacrifices for the Ukraine war. No soup for you! Protests in Europe are taking hold as demonstrators in Berlin, Germany turned out at least 10k souls to demand the government stop sending weapons to Ukraine.

“They’re rationing tomatoes in the supermarkets. We’re told it’s about supply chains, bad weather and the price of heating, but right now, in terms of the messaging, I suspect it’s more about pushing the word – rationing.”

Neil Oliver on food rationing in the UK – GBN, Feb. 25 (6:50-17:00 timestamp)

Michael Yon: BASF announces “permanent” output reductions – Mike Adams, Oct. 2022

Plan Your Trade, Trade Your Plan

TraderStef on Twitter, Gettr / Website: TraderStef.com