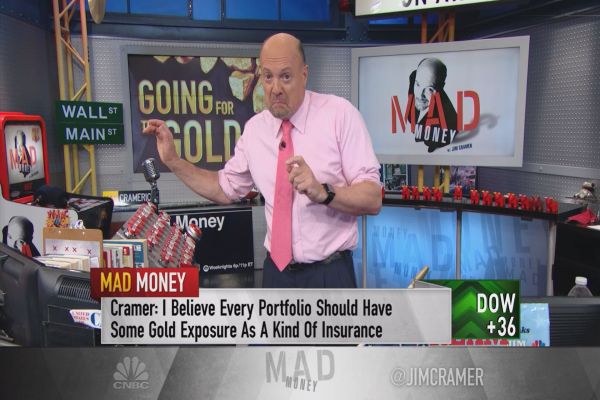

Cramer Says Buy Gold Cause Fed Is Stuck

Turbulence is something you experience when you fly. Volatility is something you experience when you invest money into things you hope will return you more money than you invested. Volatility has taken over the markets the last several months created by a liquidity squeeze. Bear markets tend to go down day after day with big spikes due to liquidity corrections. Ups and downs are more frequent as volumes are much less which can move the market one way or other much quicker. Federal Reserve chairman Jerome Powell increased the fed funds rate another .25bps further contracting liquidity. Global net liquidity has decreased for many months and common sense tells you asset prices will come down with it. Even Jim Cramer is concerned (sarcasm).

Stealth QE

High stock prices are a misnomer to a prosperous economy. Stocks are manipulated, and the public believes that means the economy is strong. A floor has been established under stocks because of stock buybacks from wealthy companies. Rich executives get paid in stock, so they buy back their own shares to bid the prices higher. Stock buybacks are a form of stealth QE that keep prices higher. For decades stock buybacks were unlawful, but now all one can see is report after report showing the record amount of companies buying back their own shares. Higher interest rates are putting zombie companies out of business and making cash rich companies re-think cashflow. Year-end pushes to book cash or bring invoices in early to doctor the books are nothing new. As you can see, filings of buybacks just in the last part of the year are rampant.

Cramer Conundrum

Headlines are already being floated by financial advisors to have the Federal Reserve come to the rescue. They are calling for the balance sheet reduction program to be halted to save the market. Everyone already knew that the FED would never be able to balance. Even the mainstream media is catching on. A motto to follow when listening to the mainstream media is to do the opposite of whatever they tell you. Jim Cramer is one of those people and programs such as his have a track record of leading people to slaughter. Cramer is closer to a car salesman than anyone who knows anything about stocks. That’s why his recent message to viewers caught my eye.

“I feel powerless, just like 2007, when I ranted that the Fed needed to start easing aggressively in order to stave off a financial catastrophe.”

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

What is striking is that in one of his latest episodes he spoke some truth. He mentioned that consumer and corporate spending is falling off a cliff. To my surprise he recommended buying gold. He mentioned buying some mining shares that track GLD. We all know owning anything to do with GLD is a scam. The best play is to own mining shares and real gold. A policy blunder is inevitable and when is anyone’s guess. Cramer also went on to say that selling would not be wise because the Fed will have to reverse course.

“Sooner or later, the weakness will be undeniable, and he’ll have to change course, which is a reason why you can own stocks.”

If Powell reverses course, we either get a 30% decline in the USD or DOW 100K or both?

That is the question, will QE drive stocks like before but kill the dollar this time? Will the dollar crash 30% like Ray Dalio says and gold goes to unheard of levels? History tells us that we are at the outer boundaries of what the system can handle. Holding precious metals for an eventual USD devaluation is prudent. Even Jim Cramer says buy gold. Pigs must have grown wings.

Cheers,

Colin

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Legal Notice: This work is based on public filings, current events, interviews, corporate press releases, and what we’ve learned as financial journalists. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment, or tax professional should be sought. Never base any decision off of our emails. Never base any decision off of our emails. Please use our site as a place to get ideas. Enjoy our videos and news analysis, but never make an investment decision off of anything we say. Please review our entire disclaimer at CrushTheStreet.com.