An indicator that the uninformed investor doesn’t use is one they should. After a tumultuous decline in equity prices around the world, the average investor is wondering what gives. Historically, market volatility shows up around market tops. Millennial investors are not used to a lot of volatility, as we were raised in a time with unprecedented market intervention. Panic seems to set in and logic subsides. Inflexion points occur, and we may be there right now.

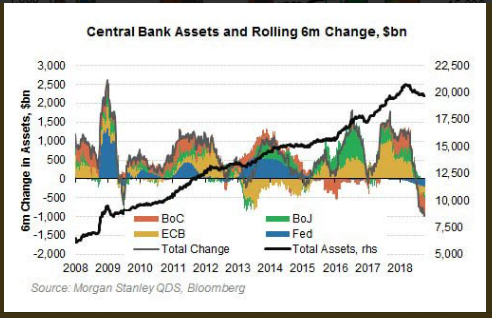

An indicator that should be followed is the Smart Money Index and money flows of the S&P 500. The Smart Money Index measures market sentiment and the flows of capital in and out of the market. As you can see, the beginning of the year brought about a major confidence shift. We’ve seen smart money selling to dumb money (retail investors) all year. When you look at the reduction in the Fed balance sheet, you can see the decline. When the supply of assets on the market is diluted, asset prices will fall, and the dumb money doesn’t pay attention to this.

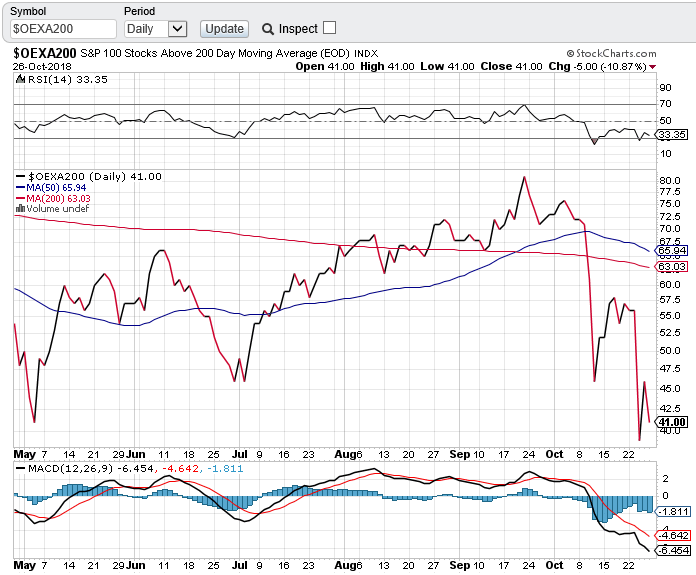

It is no coincidence that higher interest rates have led to stock market volatility and a housing slowdown. New mortgage applications are at 20-year lows and every statistical measure in the housing market is down. Existing home sales are down 6 months in a row, as mortgage costs are increasing daily. If you look at the S&P 500, you can see 100 stocks above the 200-day moving average are nonexistent. Stock market gains are now gone for the year, and we are in correction mode.

If the Federal Reserve truly wants to normalize its balance sheet via quantitative tightening and raise interest rates to normal levels, the stock market would have to fall 30%-50%. I don’t see them being able to do that, especially with the debt burden around the world. It’s not just the Fed trying to normalize, either. Every major institution is trying to normalize, as seen by the asset reduction in 2018 and the Federal Reserve is bringing pain to the emerging markets. All you have to do is look at their currencies in terms of gold.

If the U.S. market corrects another 10%, the Fed may be forced to pause raising rates. The Fed will ultimately have to cut rates to provide liquidity back to the market in the next crisis. Pausing in December already looks like it is on the table.

Fed funds futures already show that the probability of an interest rate hike in December is down from 80% to 69.9%and more downside will make this probability 0% before long.

One thing that bothers me is inflation. As an investor, you should be very cognizant of it and what it does to your purchasing power. That’s why I am always confused about why the Fed uses the Personal Consumer Expenditure deflator to determine inflation. This metric excludes food and energy. We use both items every day, and yet they exclude them. For month-end September, the PCE core deflator was 1.6%, versus an expected value of 1.8%. Powell tells us we are worried about inflation, but this metric tells us we shouldn’t be worried. I know there is much higher inflation than reported if you just look around. Smart money doesn’t buy it, either, which is why they buy hard assets, and you should, too.

Cheers,

Colin