Markets Turning on a Dime: Trade War Progresses

Turning on a dime… This is something markets tends to do as fast as my 4-year-old goes from peak euphoria at Disneyland into a screaming tantrum in the line for popcorn.

Out of seemingly nowhere, things can change.

Look at how fast inflation has historically kicked into high gear over the past 100 years. It’s seemingly normal one year, then spiraling out of control two years later:

And believe me, one thing we know for sure is that the mainstream media wasn’t talking about inflation then, and they surely aren’t warning about it now.

I say this all to point out that a sense of normalcy could be ripped out from under us as quickly as a car blindsiding you unexpectedly at a busy intersection.

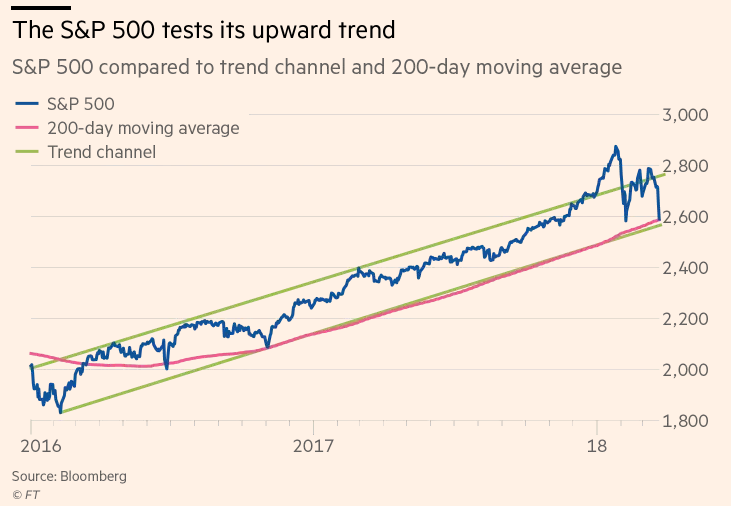

Off the heels of the worst week in stocks after two years, markets are gathering their bearings. Markets are dealing with corrections that I see signaling a further confirmation of accelerating the roller coaster ride they’ve been on.

This sell-off has been largely tied to tariffs and potential trade wars. It’s important to note that investor shock is typical across the board, even though Donald Trump telegraphed his plans almost specifically during campaign rallies.

While it’s easy for the media to attack Trump for his attempt to level the playing field, it’s important to point out the double standard with China’s tariffs on certain U.S. goods and Europe’s tariffs on U.S. cars.

The U.S. has been the least protectionist large economy in the world, while many other countries are far more aggressive.

The problem with a trade war is that it potentially destabilizes global peace and encourages positive global sentiment. Of course, rocking the boat shakes that narrative.

Trump is reacting to unfair treatment. He’s not acting first, but rather reacting to many of the U.S.’ trading partners not playing by the “rules.” I put rules in parentheses because no country, entity, or individual has to do anything, but for society to be functional, working together is crucial.

Right now, China is dumping subsidized steel into U.S. markets at much lower prices and inferior quality. A tariff has been ordered by the POTUS to help rebuild the domestic steel industry, assist in rebalancing the trade deficit, and encourage trading partners to renegotiate trade deals from the past that are unfair.

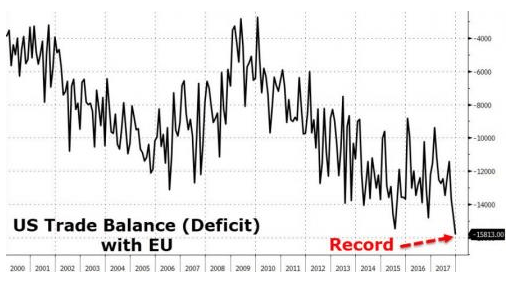

Europe retaliated against Trump’s steel and aluminum tariffs, announcing that they will meet these tariffs with counter tariffs on U.S. goods, including Harley-Davidson, Bourbon Whiskey, and Levi’s jeans. But considering Europe already imposes tariffs on U.S. exports going into Europe, it could be said that Trump is just leveling the playing field.

After all, the current trade imbalance with Europe is at a record:

China About to Launch “Tens Of Billions” More In Tariffs… “China’s real retaliation – one which is guaranteed to infuriate Trump with its proportionality and lead to further tit-for-tat responses – is about to hit. As a reminder, here is a list of the main US exports to China, which – if this warning is accurate – are about to be crushed” – ZeroHedge

Wars are never good or easy. The war in Afghanistan has been the longest running war in U.S. history, and it’s still going on. It’s literally a war that will have veterans including both parents and children serving.

I believe these tariffs will push inflation higher on their own, and higher inflation is a threat to the valuations of more or less all financial assets today. But the greater threat is that this escalates into an actual trade war of countries continuing to one-up each other without actually negotiating and peacefully trading. A trade war would increase prices on a much broader array of goods and services, while simultaneously depressing aggregate global demand.

Although this “trade war” could get ugly, with impacts that can continue to rock markets and potentially cost jobs in the process, I also believe Trump will gain concessions from other countries and renegotiate prior imbalances that were otherwise overlooked, with the full ability to scale back tariffs when negotiated terms are met. The quicker this happens, the less damage will be done.

Having said that, we have a perfect storm of events happening that when combined are adding volatility in the markets. Last week was tumultuous, marked by fears of a trade war, tightening monetary policy, a data mining scandal at Facebook, and the latest turns of the revolving door at the Trump White House have sparked the fire that led to the worst week for markets in two years. By the way, many see the revolving door of the White House as a bad thing, but one thing it suggests is that Trump is not beholden to the “Deep State” and will stick to his beliefs.

I believe stocks could continue to plummet, retracing 20-40% from their

January 2018 highs as “wars” escalate and fear sweeps.

For this reason, it’s very important to be positioned in assets that have a history of monetary protection. Keep in mind that the petroyuan is now officially a competitor to the petrodollar, and trading recently commenced. This is part of the Band-Aid tear away from U.S. dependence, preparation, and significant increases in gold reserves for both China and Russia as they seek to unseat the USD as the world’s de facto trade currency.

Until next time, stay vigilant…

Prosperous Regards,

Kenneth Ameduri

Chief Editor, CrushTheStreet.com