Cloud Mining – What You Need to Know!

Since Bitcoin’s inception, many people have attempted to earn bitcoin through a process called mining. Mining is the term used for generating new bitcoins by using a CPU or GPU for solving complex mathematical algorithms, which yield the reward of bitcoins.

As time progresses, the difficulty is increased. Combined with a growing number of miners, digital mining companies, and electricity costs, mining Bitcoin from home is far from profitable.

The only people/companies who can gain a return on investment with profit are the ones with access to renewable energy and the budget to set up a warehouse full of machines dedicated to mining cryptocurrency. Inevitably, people wanted to mine cryptocurrency without buying expensive hardware and paying high electricity bills… Enter cloud mining.

What is Cloud Mining, and is it Legit?

To answer this, we need to go into some detail. Firstly, cloud mining is simply a contract from a digital mining company that rents out its mining power (or hashing power, as the tech community calls it).

Hashing power is the speed of calculations processed; the more hashing power, the faster miners get rewards.

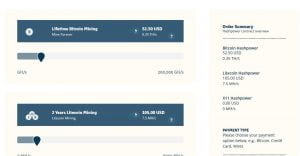

So when a Bitcoin enthusiast wants to start mining through the respective company, he will choose which currency or contract to allocate his hash power towards. For example, he may choose a lifetime Bitcoin contract or two years of Litecoin mining. Contracts vary and have different lengths of time allocated to them for mining.

This image is from Genesis Mining, a cloud mining company based in Iceland.

Once paid for, the user can then allocate their hash power within the respective contract to the different cryptocurrencies available to mine!

With the respective contract selected, you can then allocate your hashing/mining power to a wide variety of popular cryptocurrencies.

Can Cloud Mining Work for the Average Person?

This is where cloud mining can become increasingly difficult. The majority seem to be Ponzis and illegitimate, with no proof of mining equipment. HashOcean was one that has now vanished into the memories of many cloud mining enthusiasts, however, Genesis Mining seems to be the most legitimate, and even appears at cryptocurrency events.

There are several factors one must take into consideration before messing with these programs. Note that return on investment may not be achieved.

- Mining difficulty changing – As the number of people entering the crypto community and mining increases, so will the difficulty of mining. More people mining for the same rewards will mean people with less powerful equipment will be phased out, or rather hashed out!

- Price increase or decrease. If a currency is, for example, $10 at the time of purchasing a contract, and it crashes to $1, your estimated payouts may become significantly reduced and make earning a return on your investment harder.

- Contract lifespan. Certain contracts are set to expire, simply putting a time limit on achieving a return on your investment. If the previous two points I have highlighted go against you and your mining contract is set for twelve months, you may find it harder to obtain your original seed money. Only go for the lifetime contracts if you decide to do this!

These are topics people neglect to research. Cloud mining has received criticism from many different sources, and it is a haven for Ponzi schemes to thrive upon unsuspecting newbies. With the risk involved, it has been deemed as a high-risk way to invest your money.

Many cloud mining companies do not have any proof of actually mining cryptocurrencies, so investors are literally pouring their cash into a false investment. This makes it harder for the legitimate mining companies that operate above board.

In my opinion, Genesis Mining seems to be the only legitimate cloud mining company, but the variables around cryptocurrency mining must be taken into consideration.

It is far safer to just hold on to your digital currencies. Do your research, and only invest what you can afford to lose.