Another Rival to SWIFT and Visa?

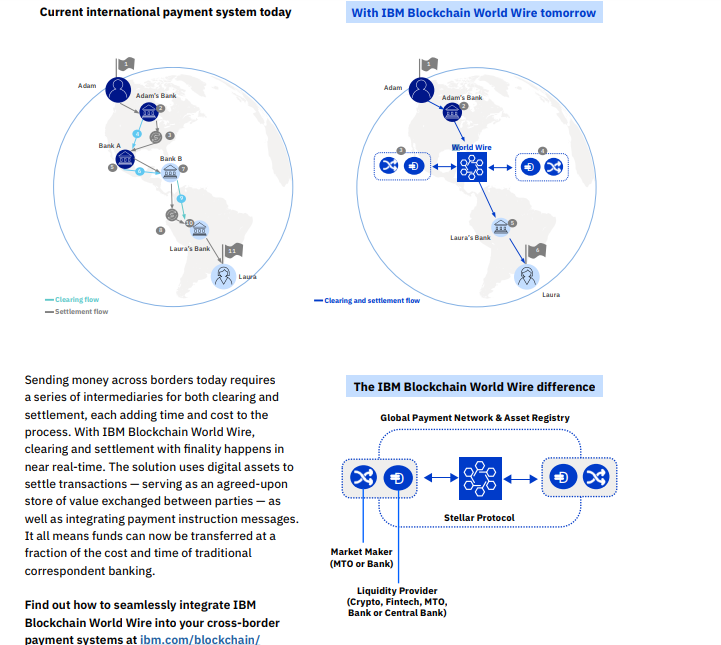

IBM has turned heads after launching a new global payment network using Stellar’s ledger technology. “Blockchain World Wire” (BWW) allows financial institutions to connect their existing payment systems to BWW’s API to enable cross-border transfers between fiat and cryptocurrencies by using a pegged cryptocurrency or stablecoin as a bridge asset between payments.

BBW is yet another contender to SWIFT, Visa, and Ripple, but despite this rivalry, the new system could also co-exist with payment providers because current institutions can integrate their existing systems.

“Two financial institutions transacting together agree to use a stable coin, central bank digital currency or other digital asset as the bridge asset between any two fiat currencies.

The institutions use their existing payment systems – seamlessly connected to World Wire’s APIs, all transaction details are recorded onto an immutable blockchain for clearing.” – IBM, Blockchain World Wire

Source: https://www.ibm.com/downloads/cas/YW3W2JPZ

Described as the “new financial payment rail,” further benefits of World Wire include less intermediaries during transactions, real-time clearing and settlement, cost-efficiency, and greater security and robustness.

Who is Actually Using This New Payment Network?

It’s well-known that IBM has a keen interest in blockchain and distributed ledger technology. The partnership with Stellar in 2017 confirms this sentiment, and it is not the first major development to come from the partnership in the recent years.

Settlements are currently supported by Stellar Lumens (XLM) and a USD stablecoin (yet another!) developed by IBM using the Stellar protocol.

According to reports online, six banks have already confirmed their intentions to use World Wire and issue their own stablecoins for settling transactions on the Stellar-powered network.

Stated on IBM’s Website, BWW has enabled payment locations in 72 countries, with 48 currencies and 44 banking endpoints. This will likely assist financial institutions in using cryptocurrencies and allows many popular digital assets to be integrated into the mainstream financial sector.

This is not investment advice; please always do thorough research and only invest what you are willing to lose, especially in times of uncertainty.