Dear Reader,

Today is the inauguration of President Trump. Trump made history in this election. While having some of the most passionate supporters, he also has some of the most vehemently angry people ever against him entering his first day of the presidency.

Prior to the election, “Trump for president” meant massive corrections to the market, a disruption of the establishment, and a reset good for the market future. Post election, markets turned bullish on a Trump presidency; pricing in tax cuts, job growth, loosening of regulations, and a more competitive country.

The only problem with everything Trump is trying to do, as noble as it might be, is that the country is at a historical Breaking Point. The pain that will have to be endured before reaping the benefits of a more competitive environment will be grueling.

For instance, take repealing Obamacare. While most Austrian or conservative economists would agree that socialized medicine has a net negative result, the repealing of this will put 10s of millions of people out in the cold with no insurance. That’s just it though, to experience the gain, you have to go through the pain because the crash from the ACA high still needs to be fully processed.

Now to be fair, for everyone who thinks people are going to be dying out in the streets without insurance, this just isn’t true in the US. If you get sick, you walk into a hospital, and they are required by law to treat you. So to that extent, medical care already is universal.

As for stocks and an overly optimistic economy, I don’t see how we can continue like this for too much longer. What we have seen from 2009 through the early portion of 2017 has been a historic equities bull market. In fact, the 10% move we’ve seen in stocks since the November election could very well be the “Blow Off Top” that every bubble market experiences.

Going back in history with just a few examples, The Blow Off Top happened when Bitcoin went into bubble territory in 2013, equities in 2008 and 2000, gold in 1980 with massive crashes to follow.

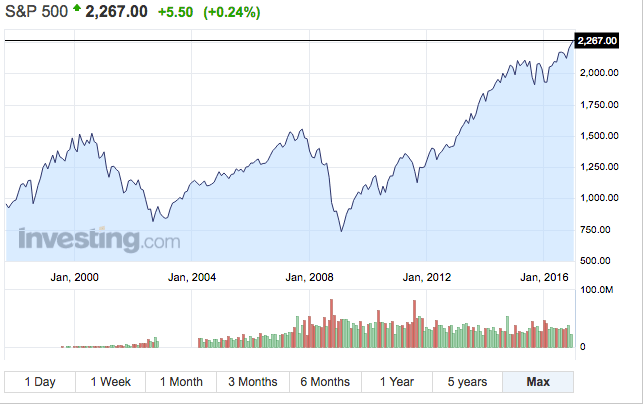

For a moment, I want you to forget about the public/private debt, government expansion, money printing, expensive/cheap markets and just look at this chart of the S&P 500:

What does your instinct tell you? Nothing goes straight up forever, historically and looking at that chart, we know emphatically that this is true.

Could the “Trump trade” be over? It would appear that equities might be losing some steam. Some recent economic data reported off ZeroHedge.com:

“When looking at the latest weekly fund flows, it is clear that the Trump trade is over if only for the time being. As BofA reports, citing EPFR data, the last week saw the largest precious metal inflows in 5 months ($1.3bn), the 4th consecutive week of bond inflows ($4.5bn), and a week of modest $1.7bn equity inflows, however US stocks saw $2.5 billion in outflows, representing the 4th weekly outflow in the past 5 weeks.”

Let’s not forget about China either. China could very well be preparing to devalue its currency again. It’s a currency war for country’s in desperate need of salvaging what is on the verge of a massive collapse. Market volatility will and certainly has hinged on this.

When China last devalued their yuan between December 2015 and January 2016, global stocks initiated off the year to their worst start in history. This was a 2% devaluation. You might also remember, that this was also just after the US raised interest rates for the first time in a decade which strengthened the dollar.

It’s important to note that China previously devalued 4% in August 2015, and this was powerful enough to send the Dow freefalling 508 points in one day. What China does with its currency certainly has major impacts on the US markets. That 508 down day was the Dow’s 8th worst single-day crash in its history.

Dollar strength against the yuan was enough of an issue for Trump, which he commented on it this last week and said that the US dollar is “too strong” against the Chinese currency, and the dollar sold off on that news.

When it comes to Trump playing “chicken” with other countries, I think he is sending a strong message across the board that shows he doesn’t blink.

We are in unprecedented times and future uncertainty could not be overstated…

While I am happy that the establishment globalist, Clinton, was not elected, the inauguration for President Trump will certainly be the start of an incredibly rough road ahead. Considering the main stream media and current establishment will be chomping at the bit to blame anything and everything that implodes during the Trump presidency on him. Trump has no other choice but to OVERDELIVER if he has any chance of being reelected.

To that end, I say to you, be aware of the uncharted waters that we are in and don’t be overly exposed/dependent on the current financial system.

Prosperous Regards,

Kenneth Ameduri

Chief Editor, CrushTheStreet.com