It is the time of the year to look into the next year, and identify the major issues and challenges. We believe investors should be watching the following 3 themes very closely.

1. Debt Bubble and Currency Wars

The global governement debt currently stands at $62 trillion, a mind-boggling figure. Compare that with the global GDP which is approx. $72 trillion. The whole planet has a debt ratio of 80% compared to its total economic output. Talking about a bubble! Looking at the 4 major regions in 2015, we see an outspoken debt growth in Europe and Japan, a stabilization in the U.S., and a slight decrease in China.

The government debt bubble will grow bigger in 2016. It means that governments will continue to devalue their currencies to alleviate their debt burden. Currency wars and debt growth will continue to reign our central bank policies in 2016. We did not see an apocalypse of this bubble, so we expect that the bubble will simply grow bigger. Similar to a ‘regular’ war, there is no constant battle. Rather, battles take place occassionally. Investors better avoid investing in currencies in 2016.

2. Interest Remain Historically Low

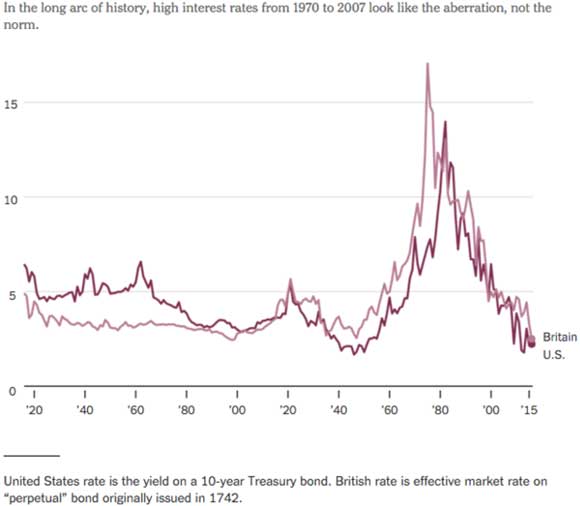

The overhyped interest rate hike by the U.S. Fed was already a big bubble in previous years. But it reached ridiculous levels in 2015. To put things in perspective, we pulled up the long term interest rate chart, with the 10 yr Treasury yield as the reference for interest rates in the U.S.

As one can see, the recent overhyped interest rate hike is totally meaningless on this chart. In Europe, interest rates are going lower and lower. The U.S. Fed pretends that it will hike several times in 2016. One thing remains clear: we are still living in exceptional times, and 2016 will not be any different.

3. Deflation Remains the Enemy of Central Banks

Central banks have been fighting deflation in 2015 as it was and remains their biggest enemy. However, the bad news for central banks is that the 5y forward inflation expectation rate is not coincidentally at its lowest level since 2009.

Central banks are committed to fight deflation, with all means. The Fed, in its latest announcement, added an important sentence to underline their focus on their inflation objective, see the sentence on the chart above, which comes from the Fed’s announcement. Central banks WILL get inflation. The risk is that inflation could get out of hand, as it can rise in a very unexpected and sudden way.

Should we expect inflation in 2016? Based on the current course of things, the most likely answer is “no”.

What does all that mean to investors and gold bulls?

Because the gold price and inflation expectations are highly correlated, we do not see a raging bull market in gold in 2016. On the other hand, we believe the downside in gold is limited, as the gold price has already priced in an interest rate increase. Also, the Fed will only continue its path of rate hikes as soon as inflation starts picking up.

Gold will bring monetary protection, but probably that’s not what will be the key theme of 2016. We expect rough markets in 2016, and recommend to stay away from currency trading and bond buying. A select number of growth stocks could be considered for a portfolio. And a steady accumulation of deeply oversold quality miners could be interesting for the long term.

Our most effective recommendation to increase your wealth in 2016? Activate your entrepreneurial talents, and develop an activity to create a steady source of revenue, by creating value in this world.