The world has changed drastically since penning Part 1 and 2 about the Fed’s Taper Caper dilemma that’s buried deep in the mainstream financial press as a potential policy failure or another behind-the-curve monetary response by the FOMC. Policy and economic wonks that publish independently are usually ignored by legacy media and invited back when it’s apparent that the Fed may be forced to fold on its monetary policy agenda. One of the first signals of that dynamic is when Peter Schiff was interviewed on Dec. 13 by Tucker Carlson. Schiff is not the only underdog, but he was highly publicized in the buildup to the Great Financial Crisis (GFC) and is a good example to reminisce if you weren’t old enough to experience it or you missed it. Schiff was demonized in public by pundits on mainstream financial networks for his analyses and warnings of “doom” before the GFC. Eventually, pundits were eating crow.

One elephant in the room is whether the Fed can afford to fold. The FOMC is likely to punt a dovish fractional increase in the Fed funds rate at the March meeting due to high inflation and save face. Unfortunately, nearly all the economic data is indicative of an end to a business cycle with a recession on the horizon. Here is an excerpt from Part 1 and a current list of points that do not cover all the topics that may dissuade the launch of a hawkish policy stance for an extended period of time:

“Jerome Powell testified in front of Congress last week for a second-term confirmation and tiptoed around the Federal Reserve’s plan on tapering its accommodative monetary policy to ‘rate normalization’ in 2022 and beyond. The barrage of questions about the global and domestic economy, taper planning, and policy matters from your elected officials on Capitol Hill was met with answers predicated by Fed speak safety nets that included ‘maybe,’ ‘expect,’ ‘willing to adapt,’ ‘must be humble,’ ‘depends on the data,’ ‘we honestly don’t know,’ and ‘no decisions made at this time.’ There was no definitive answer to the requirements for a quickened taper and normalization… Fallout in the global economy continues as multiple signals point to prolonged economic malaise heading into spring… In addition to an ongoing supply chain crisis and other issues, several geopolitical hotspots are not going away, and Russia vs. NATO over Ukraine took the spotlight in recent days when talks collapsed with no sign of a restart. If diplomacy is not re-engaged immediately and efforts made by all sides to make concessions, a major outbreak in the Balkans or elsewhere will only increase stress on global supply chains as the potential for WWIII takes over the mainstream media.” – Jan. 16, 2022

- Russia’s invasion of Ukraine commenced on Feb. 20

- U.S. allies and NATO partners are imposing sanctions on Russia

- Agreement among Western allies to restrict Russia’s access to SWIFT

- Bank runs in Russia and financial market contagion without liquidity

- Major corporations are selling their stakes in Russian businesses

- TBTF banks like JPMorgan are suspending specific funds from trading

“Here’s what Biden’s team of amateurs don’t understand. Every payment, every trade has two sides. When you blow up one side (Russia) you also blow up the other side (world banking system). Linkages are dense and immensely scaled. This could be the worst liquidity crisis ever.” – Jim Rickards, Feb. 27

Russia faces financial meltdown as sanctions slam its economy… “‘For a long time, Russia has been methodically preparing for the event of possible sanctions, including the most severe sanctions we are currently facing,’ Kremlin spokesman Dmitry Peskov said. ‘So there are response plans, and they are being implemented now as problems arise.’” – KTVC, Feb. 28

Investors in Russia face mark-to-no-market problem… “Investors in Russia face two big questions after the United States and allies restricted Russia’s access to SWIFT… The first is whether investors will be able to sell. Russia’s equity and derivatives markets remained closed Monday, while the central bank ordered brokers not to execute sell orders from foreign shareholders… The second question is whether they’ll be able to get their money out… It’s far from clear what investors like Norway’s sovereign wealth fund, which said it was selling its $2.8 billion portfolio of Russian securities will get back.” – Reuters

- Putin countered NATO by ordering nuclear deterrence forces on high alert

- NATO partners supplying Ukraine with weapons, advisors, intelligence

- Russia says European Union sanctions won’t be left unanswered

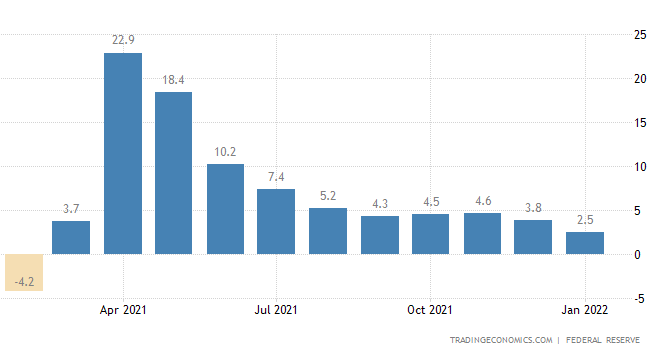

- U.S. manufacturing data is trending downward

Chart Courtesy of Trading Economics

- U.S. services sector survey plunged to 18-month low in 4Q21

- U.S. trade deficit in goods greater than $1 trillion in 2021

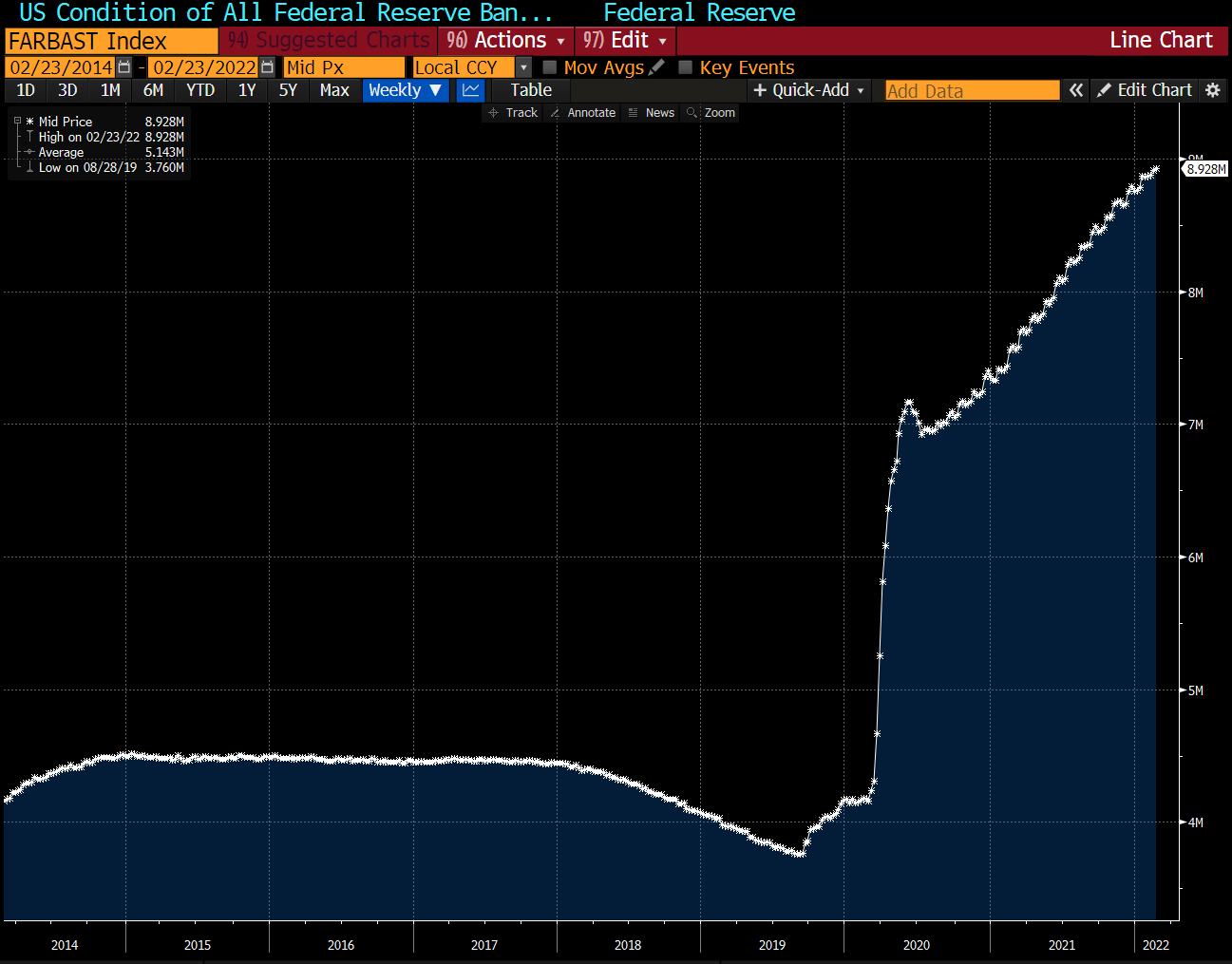

- The Fed’s balance sheet at $9 trillion and still purchasing assets

Chart Courtesy Lisa Abramowicz

- U.S. GDP collapse, mortgage rates rising, Treasury yield curve flattening

Chart Courtesy of Confounded Interest

- Real personal disposable incomes are down an epic 10% YoY

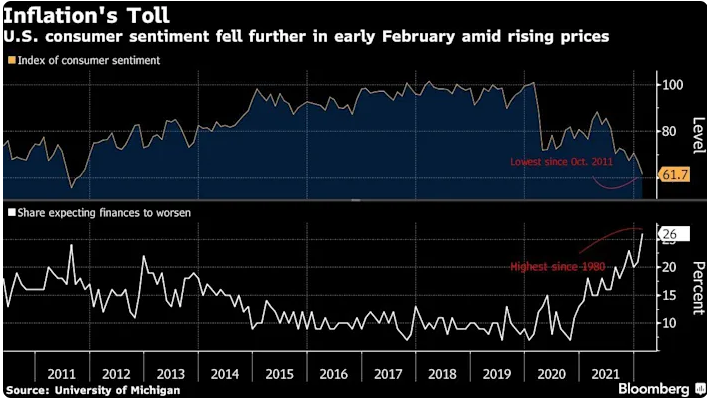

Chart Courtesy of David Rosenberg

- Consumer confidence fell to a five-month low in February

- Consumer sentiment plunged to a 10-year low with inflation

- The fastest pace of credit card debt in 22 years during 4Q21

- Housing affordability crushed, especially for first-time homebuyers

- The job market data is not healthy no matter how it’s sliced or diced

“ADP shows payrolls down 301k and the pundits are ‘looking through’ the data as solely omicron-induced. So let’s see — the impact on inflation is deemed permanent, but one can safely use the word ‘transitory’ to describe the economic impact without ridicule. Give me a break.” – David Rosenberg, Feb. 2

- High cost of energy is triggering inflation within the supply chain crisis

More can be added to the above list, but the cost of energy infiltrates everything and takes the cake. The war is forcing the price of oil higher and will conceivably rise well beyond $100 per barrel. Russia may retaliate against sanctions by reducing or turning off the flow of natural gas into Europe.

A worst-case scenario will plunge Europe into recession in short order and prompt the European Central Bank to postpone any rate hikes into the indefinite future. In the U.S., a deep recession across the pond with a spike in credit premiums and a rally in the dollar would cause a shock. The Fed would be cornered with inflation soaring even higher than anticipated and would be forced to raise interest rates as the U.S. spirals into recession. Something has got to give, and the prospects are not pretty given the circumstances the world is in. Gold is getting positive coverage and rallied above $1,900 last week due to the circumstances noted above.

Gold Outshines Treasuries to Be Top Hedge Against Ukraine Risk… “The precious metal is gaining in popularity after Russia’s invasion of Ukraine drove Brent crude prices above the $100 mark last week for the first time since 2014. Bullion jumped about 6% this month, while an index of U.S. sovereign bonds slid 1.5%… The worst geopolitical crisis in Europe since World War II has redefined the limits of safety for investors as costlier commodities add to fears of accelerating inflation… ‘The whole crisis has gone to a level that we couldn’t have believed, and investors are no longer saying we’ll buy some defensive stocks or bonds,’ said Global CIO Office chief executive officer Gary Dugan. ‘It’s now about buying gold especially against the backdrop of inflation risks that have been made worse by the conflict.’” – Bloomberg, Feb. 28

Guns N’ Roses – War

Plan Your Trade, Trade Your Plan

TraderStef on Twitter, Gettr / Website: TraderStef.com

Headline Collage Art by TraderStef