When it comes to sovereign nations that desire an exit from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network, the reason dominating mainstream coverage is an effort to end the reliance on a dollar-based hegemony. Nations who grab the headlines are those who coincidentally already have a gold hoard, such as the European Union, and the majority of others were busy accumulating gold over the last decade or so with de-dollarization in mind.

A less discussed issue as of late is the cyber threat with financial networks. For decades, industry-specific technology has found SWIFT benefited from “Security Through Obscurity” (STO), but contemporary cyber criminals tend to be more determined, possess higher skillsets, and can be well funded if a source has the backing of a fraudulent sovereign player or an espionage flavor with malicious intent. The problem with STO is that the whole system can collapse after the first person finds out how the protection works. There is always someone determined enough to uncover those secrets regardless of their motivation.

- How Hackers Stole $81 Million from Bangladesh Bank Undetected – Hacker News, Apr. 2016

- SWIFT Banking System Hacked at Least Three times This Summer – Fortune, Sep. 2016

- SWIFT warns banks on cyber heists as hack sophistication grows – Reuters, Nov. 2017

- Hackers stole $6 million in Russia bank attack via SWIFT system – Reuters, Feb. 2018

- Famous India Bank SWIFT/ATM System Hacked For US$13.5 Million – Gbhackers on Security, Aug. 2018

A better gamble would be to ensure that no one mechanism is responsible for the security of an entire system, known as Defense in Depth (DID). “The strategy is based on the military principle that it is more difficult for an enemy to defeat a complex and multi-layered defense system than to penetrate a single barrier.” DID systems include obscurity, strong password protection, state-of-the-art encryption, and eliminate backdoors as they arise. Solid security measures put systems behind a lock and combination, as one does with a safe. The system could even be open source because what makes it secure is that no one can get inside it but you. It’s kind of like keeping your gold in a safe that is immediately accessible and removed from any counterparty risk.

With the idea of counterparty risk in mind, several sovereign nations are in the process of removing their financial transaction capabilities from the SWIFT system.

The Only Russia Story That Matters… “Russia has created an alternative to SWIFT. The head of Russia’s central bank, Elvira Nabiullina, has reported to Vladimir Putin that ‘There was the threat of being shut out of SWIFT. We updated our transaction system, and if anything happens, all SWIFT-format operations will continue to work. We created an analogous system.’” – Jim Rickards at the Daily Reckoning, Oct. 2017

SWIFT Vs. Emerging Alternative Payment Systems – Gold’s Silk Road Trail to Petroyuan Relevance – TraderStef, Nov. 2017

Russia entrusts its gold to no one, has zero bullion in US… “We do not have a gold reserve in the US, we have only Forex (foreign exchange) reserves abroad. No one can lay hands on our gold.” – Anatoly Aksakov, Chairman of the State Duma Committee on Financial Markets, Apr. 2018

Where does gold fit into the big picture with tariffs, sanctions, and alternative payment systems? The new “Axis of gold” includes Russia, China, Turkey, Iran, and others who are working on removing themselves from a U.S. dollar hegemony, and if they are accumulating gold as well, it cannot be hacked, deleted, devalued, or frozen even if the enemy knew where you kept it.

CNN Money: Jim Rickards on Russia’s Gold Reserves – Aug. 26

Switzerland spilled the motivation beans behind the sovereign gold repatriation trend loud and clear back in June.

Switzerland chooses gold bullion over paper wealth backed by US dollar… “’It makes common sense under the actual circumstances to assure it is stored in the home country, Switzerland, instead of London or the US, which reminds me of the central bank repatriation,’ the analyst added.” – RT, Jul. 11

Amid U.S.-Turkey Crisis: Russia Says Dollar’s Days Numbered as Global Trade Currency – Haaretz, Aug. 14

In Europe, a Growing Push To Escape the Shadow of the U.S. Dollar & SWIFT – Stratfor – Aug. 22

Is Germany Moving SWIFT-ly To CIPS? – The Daily Coin, Aug. 22

U.S.: Republican Senators Push to Disconnect Iran From SWIFT Banking Network… “’In May, French Economy Minister Bruno Le Maire argued that Europe needs to reclaim its ‘economic sovereignty’ after Washington withdrew from the Iran nuclear agreement. Germany’s voice adds considerable firepower to this broader appeal.’” – Stratfor, Aug. 23

Time has come for Russia to finally ditch the U.S. dollar – Foreign Ministry… “’Russia will definitely respond to Washington’s latest sanctions and, in particular, it is accelerating efforts to abandon the American currency in trade transactions’, said Deputy Foreign Minister Sergei Ryabkov… ‘Thank God, this is happening, and we will speed up this work, and ‘retaliatory measures’ as a response to a growing list of US sanctions.’” – RT, Aug. 24

US Pressure on Iran to Facilitate SWIFT Alternative… “Despite anti-Iran sanctions, many European companies have been seeking alternative routes to doing business with Iran. What consequences can this have on the bloc’s ties with Washington? There are many companies throughout the European Union and the world that want to continue trading with Iran. What consequences will this actually lead to? ‘It will be a full-blown economic and financial war between the two continents and it will come to a point that some actions, some activities that are already happening need to be renegotiated through other international treaties or through the World Trade Organization or through the United Nations.’” – Financial Tribune, Aug. 28

End Of Petrodollar Hegemony May Happen Soon and Badly Impact Indebted America – Goldcore, Aug. 28

The anti-dollar awakening could be ruder and sooner than most economists predict… “The United States is currently waging economic warfare against one tenth of the world’s countries… These include Russia, Iran, Venezuela, Cuba, Sudan, Zimbabwe, Myanmar, the Democratic Republic of Congo, North Korea and others on which Washington has imposed sanctions over the years, but also countries like China, Pakistan and Turkey which are not under full sanctions but rather targets of other punitive economic measures. In addition, thousands of individuals are included in the Treasury Department’s list of Specially Designated Nationals who are blocked from the U.S.-dominated global financial system… America’s global supremacy has been made possible not only thanks to its military power and its alliance system but also due to its control over the plumbing of global finance, particularly the broad acceptance of the dollar as the world’s reserve currency… since World War II… Revisionist countries that wish to challenge the U.S.-led system see (sanctions and tariffs) this as an affront to their economic sovereignty. Which is why both Russia and China have developed their own versions of SWIFT… Both countries are also urging their trading partners to ditch the dollar in their bilateral trade in favor of indigenous currencies. This month Russia was quick to recruit Turkey into the anti-dollar bloc.” – Gal Luft for CNBC, Aug. 28

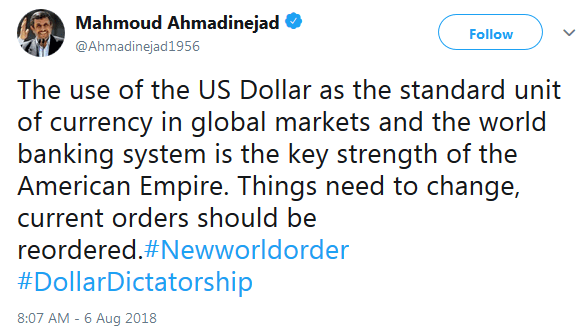

Ahmadinejad, the former president of Iran, chimed in a few weeks ago about USD de-dollarization…

Nancy Sinatra – These Boots Are Made For Walking

Plan Your Trade, Trade Your Plan

TraderStef on Twitter

Website: https://traderstef.wordpress.com