Gold and silver miners are going through the longest and strongest bear market … ever!

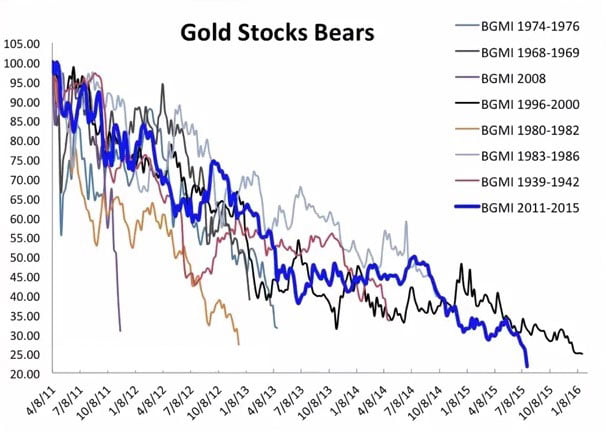

The chart below depicts 8 bear markets in precious metals miners, in the last 100 years. It shows the price of the Barron’s Gold Miner index.

It is clear from the chart that the ongoing bear market is the strongest one when it comes to the price decline. From peak to trough (prices of last week), precious metals miners lost almost 80% in value. That has never happened before.

The other observation is that the duration of the decline is close to being the longest one (the one between 1996 and 2000 was two months longer).

Here is the key question: how much downside is there left in this bear market? The answer is unknown, but most likely it is limited, even if we would go through a capitulation phase. We still do not exclude capitulation, given the extreme level of bearishness and unusually bad sentiment.

Precious metals are known for their aggressive moves, both to the upside and the downside. Given that, we should expect sharp rallies as precious metals are trying to find a bottom.

We would refrain from the gloom and doom gold price predictions, for sure the ones below 850 USD per ounce. In 1980, gold peaked at exactly 850 USD. So given all the inflation in the system in the last decades, it seems quite unlikely that gold will go structurally below that price level. That implies that the downside is limited, but the upside could be quite aggressive, for sure in the gold mining sector.

You should follow gold miners closely in the weeks and months ahead, looking for a trend reversal.