I am publishing technical analyses on gold more often as it has risen to challenge $1,300 resistance amidst a torrent of geopolitical, economic, and domestic issues that can influence its price performance in the near-term.

Gold is gaining a lot of attention lately due to the following:

- Mergers and acquisitions by major miners to guarantee their survival in a peak gold environment

- Geopolitical uncertainties and concerns over global growth and the U.S. economy

- Stock markets plunging into bear market territory

- Federal Reserve on the verge of pausing their Quantitative Tightening program

- The weakening of the USD global reserve status and its purchasing power

- Real interest rates remain near or below zero, with a U.S. yield curve on the cusp of inversion

- Central banks around the globe continue to hoard pet rocks at unprecedented levels

- Gold is proving its safe haven status role by retaining capital in a world on the edge of turmoil

One item in particular I would like to put to rest at this time is the gold-to-silver ratio. When I decide to fill up my heating oil tank or car and lawnmower at the gas station using fiat currency as a medium of exchange, the price ratio between kerosene and super unleaded or regular gasoline is not a consideration. An example of ratio uselessness is when the price of silver rocketed to its high and collapsed six months prior to gold making its high in 2011. Ratios are a nice talking point that fill an analyst’s time, but that is about all it does. A price, trend, pattern, and low-risk position timing are not determined by an after-the-fact metric. If you feel a need to elaborate on whether the chicken or the egg came first (it was an “egg,” by the way), you might consider resigning from financial markets, choose to read no further from here, and do not waste your precious time with ratio chit-chat while discussing real money and learning the fusion analysis trade.

“In our view, market fundamentals are priced into currencies in advance. Thus, utilizing technical analysis is a more helpful form of analysis.” – DeCarley Trading

Before discussing the gold charts, let us rehash a financial market outlook by Jeffrey Gundlach and peruse a few headlines and data since my analysis on Dec. 28.

DoubleLine’s Jeffrey Gundlach: This is definitely a bear market – CNBC, Dec. 17, 2018

Gold Can Keep Glittering in 2019… “Don’t be surprised if it continues to shine. Gold, remember, is supposed to be a store of value, and has kept up with inflation over the long term. As Andrew Bary noted in our September cover story on gold, an ounce would have bought a good men’s suit in 1918, and still does today… While the S&P 500 has tumbled 16% during the past three months, gold has gained 8%, acting as just the hedge against market chaos that investors hope for when they buy it… Given continued uncertainty in currency markets, there’s a good chance that gold prices keep rallying. The dollar won’t look great in a slowing U.S. economy with a large fiscal deficit. Meanwhile, the euro looks cheap relative to the dollar, but the main argument for that is that the news out of Europe can’t get much worse.” – Barron’s, Dec. 28

Northern Irish savers buying gold amid fears of sterling collapse after Brexit… “A leading broker has seen a “major surge” in the number of people transferring their money into precious metals.” – Skynews, Dec. 30

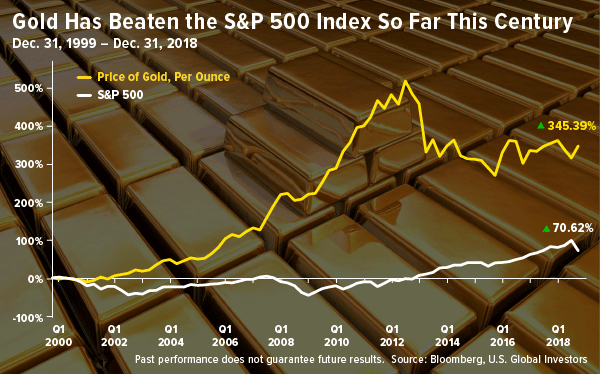

Gold Has Beaten the Market Over Multiple Time Periods – Frank Holmes, Jan. 2, 2019

BlackRock Heaps Praise on Gold’s Role as a Tough Year Opens… “Gold may extend gains as global growth slows, equity market volatility remains elevated and the Federal Reserve is expected to ease back on the pace of policy tightening this year.” – Bloomberg, Jan. 7

NY Fed Business Leaders Survey: 6mo Ahead Expectations: lowest print since the recession. Oops. – Eric Pomboy, Jan. 10

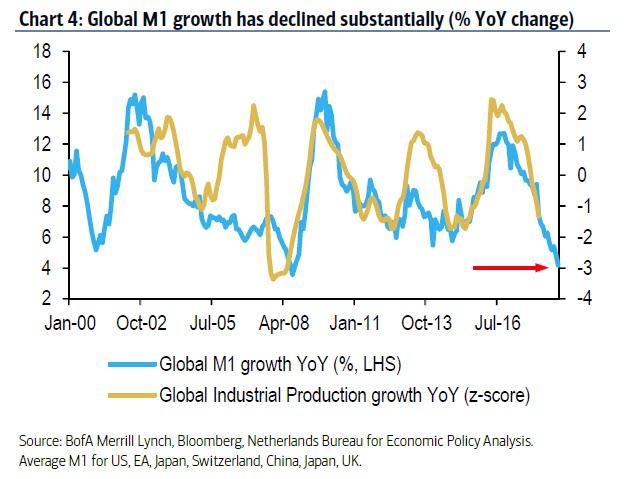

Collapse In Global M1 Signals A Worldwide Recession Has Arrived – Zerohedge, Jan. 14

Investors are bearish, GDP & EPS optimism has crashed in latest BofAML Fund Manager Survey. Corporate leverage fear has hit 10y high – Holger Zschaepitz, Jan. 15

Newmont Mining to buy Goldcorp in $10 billion deal to create world’s largest gold producer… “It is the second high-profile merger in the mining industry since Barrick Gold agreed to buy Randgold Resources in September last year to cut costs.” – CNBC, Jan. 14

Brexit Turmoil Spurs U.K. Investors to Buy Gold… “We have seen a significant increase in demand for gold this month and at the end of last year, a trend which we have no doubt is largely attributed to Brexit turmoil and subsequent market volatility,” Chris Howard, director of precious metals at The Royal Mint, said in a statement on Monday.” Bloomberg, Jan. 14

JPM Jamie Dimon: Government shutdown could reduce GDP to Zero 1Q19 if it continues – CNBC, Jan. 15

Fed’s most prominent hawk Ester George, says it might be a good time to pause interest rate normalization – Zerohedge, Jan. 15

ICYMI, first review the charts and analyses at “Gold and Silver Bullish Despite the Presstitutes – Technical Analysis” from Dec. 28.

From the Dec. 14 analysis:

“I suspect that short of a gold positive or negative news item, the price will remain stable until the FOMC meeting announcement on Wednesday. Following the FOMC, we have the potential for a government shutdown over the weekend. I remain neutral on price until the $1,251 high is taken out with conviction on the price and volume.”

From the Dec. 28 analysis:

“When the price broke away from congestion at the 200 Exponential Moving Average (EMA) and 38.2% Fibonacci level on Dec. 20, it quickly rose to a $1,281 close on Dec. 28. That was a nice $30 sweet spot–momo play opportunity. The spike in price has introduced an Ascending Scallop pattern out of a Measured Move Up. A price target can be calculated when a Throwback (aka handle) occurs after as a shallow reversal in price. A Throwback might take place as we approach the 68.2% Fibonacci level, where several layers of lateral resistance are located due to the price chop from Feb. through Jun. The studies are flashing bullish, as all the moving averages are below the price, the DMI-ADX momentum is strong with an Alligator Tongue set-up, the StochRSI is toppy but can remain there until a Throwback occurs, the MACD is positive, and buy volumes were strong during the rise in price. Keep your eyes on the 50/200 EMAs for a Golden Cross in the near-term.”

To view a larger version of the following chart, right-click on it and choose your “view image” option.

Gold daily chart as of Jan. 15, 2019…

A Throwback (handle) on the Ascending Scallop is taking shape as expected with a Symmetrical Triangle pattern. A 50/200 EMA Golden Cross also confirmed over the past week. All the moving averages are lining up nicely below the price trend. The StochRSI remained topside in overbought territory until a Throwback began, and it is now basing in an oversold position without a hint of breaking upside at this point. The DMI-ADX remains in positive territory but is stalling in momentum, which is positive while the price chops sideways within the triangle. Volumes are steady and solid, with no correlation or divergence with the price action. If the triangle resolves with a topside breach through $1,300 with conviction, the price will easily reach the next Fibonacci level at $1,323 and has a target of $1,350 based on the formula for Symmetrical Triangle breakout. If the price breaks downward and out of the triangle, the 50 EMA and $1,263 Fibonacci will provide support. It appears to be a matter of patience as to when the price chooses a direction. The lateral resistance at $1,300 is formidable and is drawn back on the chart through to 2016. I remain neutral until $1,300 is decisively breached before riding another sweet spot on this primary bull accumulation phase.

Texas Hippie Coalition – “Pissed Off and Mad About It”

Plan Your Trade, Trade Your Plan

TraderStef on Twitter

Website: https://traderstef.wordpress.com