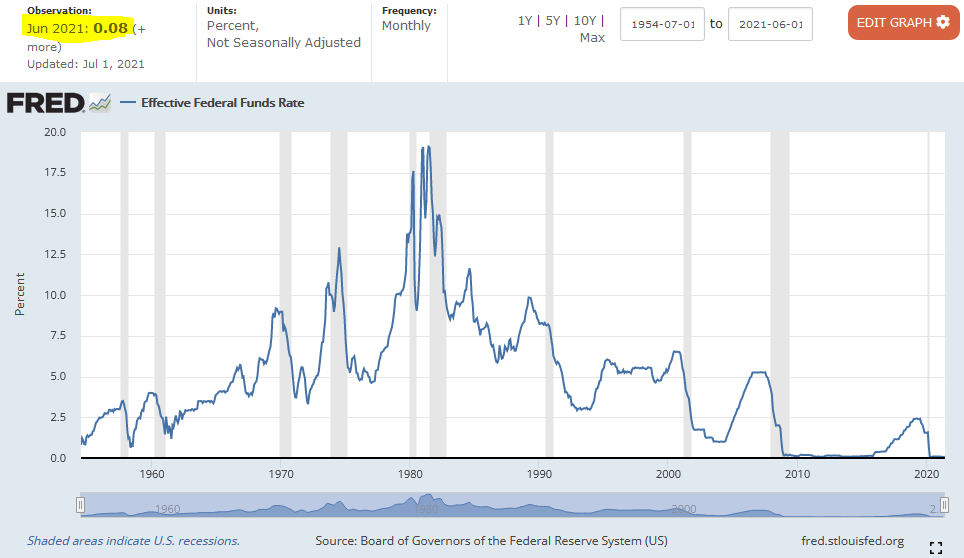

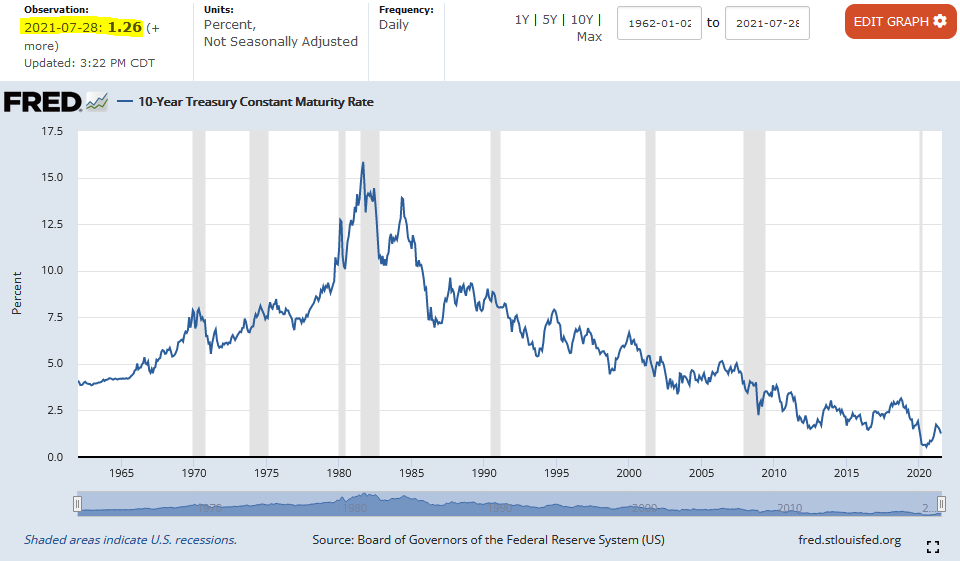

Remember when Ben Bernanke finally walked the quantitative easing (QE) taper talk in Dec. 2013, six months after letting the cat out of the bag during his May 2013 congressional testimony that launched an infamous “taper tantrum?” Remember when Janet Yellen pulled the interest rate trigger with a 0.25% piker in Dec. 2015 after seven long years of a near-zero interest rate (aka ZIRP) that followed the Great Financial Crisis, but not until Bernanke had already begun the attempt at normalization by scaling back QE3 and QE4?

Yellen managed to raise rates up to 1.5% by Dec. 2017, and after Jay Powell became the Fed Chair in Feb. 2018, he hiked rates up to 2.5% by Dec. 2020. Then, the pandemic initiated explosive fiscal and monetary policies and a return to ZIRP with an effective Federal Funds Rate low of 0.06% in May 2021. As the new Treasury secretary for the Biden administration, Yellen managed to cause a small taper tantrum when she opined in early May that “interest rates will have to rise somewhat” and promptly walked back those comments when the stock market tanked.

- Key events for the Fed in 2013: the year of the ‘taper tantrum’ – Reuters

- Fed Embarks on Interest Rate Liftoff – U.S. News, Dec. 2015

- Fed Funds Rate History: Its Highs, Lows, and Charts – The Balance, Jul. 2021

- Yellen Knows Nothing about Rates or Monetary Theory – Jim Rickards, Jul. 2021

In retrospect, it took 12 years to exit ZIRP and reach an ear-popping height of 2.5%, then only 3 months for the pandemic ZIRP to appear and thus far remain zero-bound for 16 months, not to mention the current unprecedented fiscal and accommodative monetary policies that hammered the last nail into a hopium coffin that contained a balanced budget, paying the national debt, and interest rate normalization of roughly 5%.

Before going any further in this exploration of yesterday’s FOMC meeting fallout, I strongly recommend that you first revisit “The Inflation, Deflation, and Disinflation Rabbit Hole” I published on Apr. 30, and do not skip over Dr. Lacy Hunt’s video presentation at the end. I opened that article with the following:

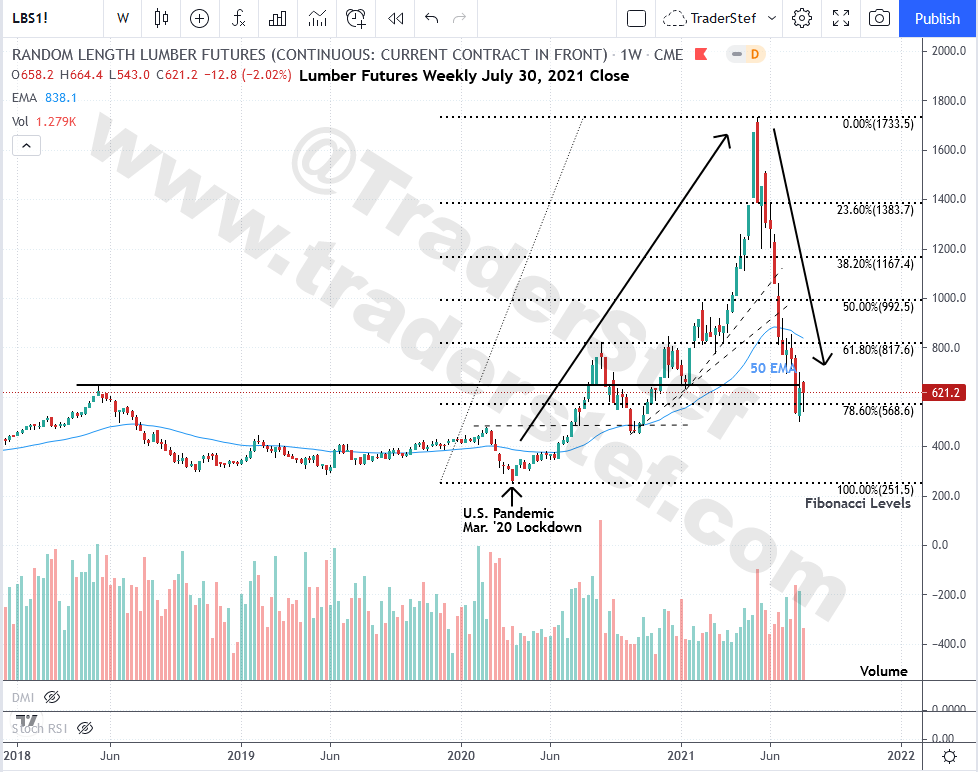

“There is a hot debate in the financial universe about the risk of runaway inflationtaking hold in the U.S. The concern is appropriate, as unprecedented monetary policy is flowing out of the Federal Reserve and Capitol Hill has launched an unending parade of multitrillion-dollar fiscal initiatives meant to shore up the economic fallout in a devasted economy caused by draconian lockdowns in a pandemic. You cannot help but notice the spike in housing prices due to metropolitan populations fleeing to the suburbs and rural areas, how the price of lumber has skyrocketed 340% from a year ago, several commodities are on fire, a bull market in stock indices continues that are not reflective of a healthy economy, and the national public debt is closing in on $30 trillion while clocking in at 130% of Gross Domestic Product (GDP).”

One example of rampant hyperinflation narratives that were being pushed is the spike in lumber prices until the first week of May ’21. As can be seen on the chart below, lumber prices abruptly returned to earth this summer as pandemic related supply-chain disruptions vs. demand dynamics realigned, which proved to be a transitory event that is unrelated to the loose monetary and fiscal policies implemented by the Fed and Capitol Hill.

On numerous occasions, I opined that we are in deep trouble if the 10-year Treasury yield and/or the Federal Funds Rate spike beyond 3% because servicing the national debt will be impossible to sustain. On Tuesday, Danielle DiMartino Booth chimed in on a question about what she thought the Fed’s intent or tapering timeline potential might be. Her answer was that if interest rates rise to a certain level, “it’s game over,” suggested that the threshold rate would be inconceivable, and to hold onto your gold. The video is preset to the 11:25 timestamp, but feel free to listen to all 17 minutes.

Here are the highlights to consider from Wednesday’s FOMC announcement and Powell’s commentary during the subsequent Q&A press conference.

- FOMC Voted 11-0 on rates policy

- Discount Rate unchanged at 0.25%

- ZIRP Fed Funds Rate range unchanged at 0.00% to 0.25%

- Continue monthly purchases of $80 billion in Treasury’s and $40 billion of MBS

- (New) Announced the establishment two standing REPO facilities – a domestic standing (SRF) and another for foreign and international monetary authorities (FIMA)

- Every country’s situation is different and patience required for supply bottlenecks to unwind

- Domestic economy is making progress toward the Fed’s goals

- The economy still has ground to cover for “substantial further progress”

- “In process” of assessing any taper but must see substantial further economic progress

- Hopes the July jobs report will bring better news on the U.S. labor market

- The ebb and flow of the pandemic and virus continues to influence Fed policy

- Despite positive momentum, risks remain along with emerging COVID variants

- Reiterated to not panic as inflation spikes are driven by transitory supply-side shocks

Several economic data releases and news items are noteworthy and do not instill a renewed taper hopium for pundits to endlessly debate. U.S. GDP grew 6.5% in 2Q21 and fell short of expectations as high as 8.4% as businesses began reopening and government money fueled a spending splurge but supply issues with employment dynamics, consumer products, and raw materials continue to blunt a full economic recovery. Jobless claims showed a surprise gain that was well above expectations. The White House announced that there will not be an extension of the eviction moratorium despite the spread of the delta variant and cited the SCOTUS. The housing boom in new home sales is over, with a dramatic 32% slowdown over the last 5 months that printed a pandemic low. Spending is falling among households with the growing wave of an end to extended unemployment benefits and federally funded payment increases. The Fed’s reverse REPO facility is approaching $1 trillion in volume a day. Economist Stephen Moore is predicting that another financial crisis will emerge within 18 months. Lastly, the global shipping industry is experiencing an additional disruption, this time by floods in Europe and China. In addition to the above, renewed concerns over COVID variants are prompting asymmetric travel bans, lockdowns, and restrictions after a temporary breather in the U.S. this spring and early summer.

No matter what the truth is about emerging variants, experimental inoculations, the technocracy, and corporatocracy, governments retain an authoritarian-like control over freedom of movement and personal choice with coordinated efforts in the U.S. of censorship to maintain a narrative, along with the global “Trusted News Initiative” (aka TNI) that is reminiscent of the Ministry of Truth from 1984. That stranglehold is beginning to loosen as protests grow around the world over draconian policies that some governments continue to enforce while informed consent (Twitter thread) starts to assert its legal authority when populations are red-pilled with knowledge.

The global dynamic will not shift until the peasantry arises and demonstrably communicates that we’re mad as hell and not going to take it anymore. The following compilation of short videos reflect the rising tension and indicates the general public and politicos may have crossed a tipping point.

Rep. Chip Roy’s Rant in the House Over Masks, Vaccines, and the Border

Actor Michael Rapaport Red Pilled by Mask Mandates After Having the Jab

UPDATE: One day after publishing the above article, mainstream media was forced to explore informed consent reality and red pilled the entire country with one CDC update. Despite facts to the contrary, The New York Times and other msm outlets of the same ilk continue pushing dangerous narratives and the unapproved gene-modifying inoculation. Nuremberg 2 is fast approaching.

“I’m Mad as Hell and I’m Not Going to Take This Anymore” – Network (1976)

Plan Your Trade, Trade Your Plan

Website: TraderStef.com / Trading Workshop

Headline Collage Art by TraderStef