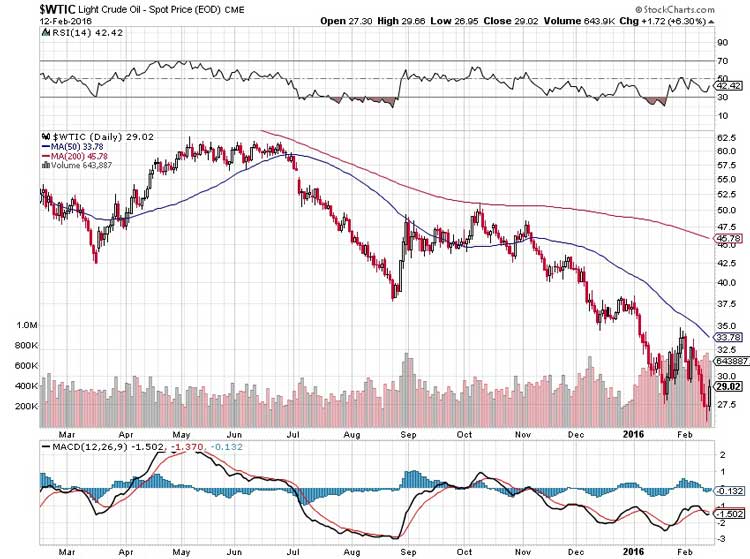

Crude oil markets are dying a protracted and painful death — and there’s not a damn thing anyone can do about it. Hope that energy-related commodities would make a rebound in 2016 were quickly dashed when the U.S. benchmark oil index West Texas Intermediate fell below the all-too-critical $30 level. Even with the massive 6% move last Friday, WTI is priced a hair above $29. That puts a lot of oil producers, especially the mid-tier names, in a world of hurt.

A quick glance at the technical charts for independent oil companies provides all the confirmation one can ask for. A notable example is Chesapeake Energy Corp. (NYSE:CHK), which lost in this year alone nearly -65% in market valuation! A common theme is present in a majority of these cases — negative profitability margins and a hemorrhaging in free cash flow. While Big Oil companies have expansive asset bases to rely upon in times of trouble, the smaller organizations simply don’t have the clout. We can definitely expect many mid-tiers to implode in the years, perhaps months, to come.

But even many of them majors can no longer say they are unaffected. During the annual International Petroleum Week, several prominent voices expressed overwhelming displeasure at present oil prices, which are preventing the industry from turning a profit. The sea of complaints doesn’t just stop at the producer level. Refiners, who are not as exposed to price volatility, have been taking a hit to their bottom line as well.

With the world awash in cheap oil, the natural solution is to artificially spike demand by restricting supply. This is a tactic that has long been threatened by the Organization of Petroleum Exporting Countries ever since the oil crisis began in earnest in late 2014. However, the question becomes who will make the first cut?

Contrary to commonly held misconceptions, not all OPEC nations are Middle Eastern, and even among them, there are regional rivalries. The biggest source of intra-communal conflict is currently between Saudi Arabia and Iran, which is only ratcheting up. Due to these rivalries, there is little to no incentive for cooperation. Why should one nation curtail production, which would then open the door to the competition? Business, after all, is about profit-making, not philanthropy.

Technically, the prognosis is very bleak. Aside from the broad price action falling into obscurity, the WTI’s long-term averages have been sliding since the summer of 2015. Other technical indicators showed some sign of life during recent blips in positive trading, but it’s likely not enough to convince potential investors to go long. Overall, volume has been extraordinarily negative — clearly, the profit is in selling the markets short, not the other way around.

That’s not something the oil industry wants to hear. Unfortunately, there’s little evidence of relief in the horizon.