So far in the month of October, the Dow Jones Industrial Average was able to claw back 5% of valuation from the short-traders, jumping the venerable index back above the psychological 17,000 point level. The news was met with great enthusiasm on Wall Street — as to be expected — but it belies the fundamental problems the U.S. faces.

No discussion on the potential future trajectory of the markets would be complete without employment figures, and the data recently released by the Department of Labor was absolutely horrendous. Jobs growth for the month of September was only 70% against economists’ forecast, and negative revisions for the prior two months stunted any arguments that the economy is in good shape.

More worrisome is the response, or the lack thereof, witnessed in critical international markets. The Shanghai Stock Exchange Composite Index is only up half-a-percent against its September 1 session, while the German DAX is marginally better over the same time frame at +0.8%. Some will be quick to argue that the last week has seen robust trading activity throughout most international markets and that China was celebrating its “Golden Week” holiday. That being said, the broader point is that despite the recent bullish surge, it hasn’t changed the technical aesthetics of the international indices.

The Dow Jones is bearishly slanted and has been mid-May of this year. The same could be said in a more dramatic fashion for the Shanghai index since mid-June. The DAX started its selloff earlier in April and Germany looks especially susceptible to further attacks from the bears.

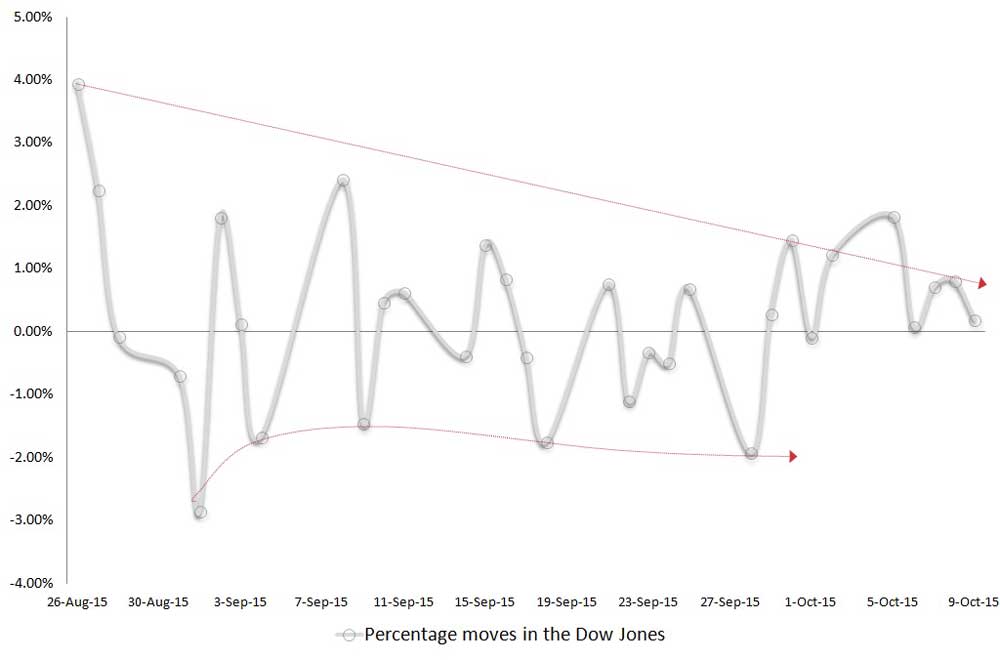

But what should really worry investors of U.S. blue-chip equities is magnitude. Specifically, the bullish momentum that was initially triggered after August’s Black Monday selloff has significantly declined in leverage. Although the Dow Jones has made progress nominally, it has done so with ever-depleting fuel. On August 26, the Dow gained 4% on a single day. Since then, we have not seen a single-day move exceed 2.5%.

Worse yet, we don’t see the same decline in momentum for bearish traders of the equities; in fact, when the markets do go south, the magnitude of extremely bearish days is consistent and prevalent, averaging -2%. This has resulted in the Dow moving fruitlessly up and down for most of the present consolidation pattern. Between August 26 and October 9, the Dow has gained 4.91%, a very similar percentage gained in the first nine days of October. This means that the index hasn’t really made much meaningful progress until just recently — and such technical victories can end very quickly on the basis of fundamental factors or just plain dumb speculation.

For now, the equity markets are up and that alone can send the dumb money crawling out of their hole. But until the major indices reach a truly substantive valuation, this rally is very much suspect.