So many investors are fighting over scraps in the tech sector nowadays. Amazon has vaulted to the $2,000 range and Google shares are literally $1,200 apiece, but some retail traders insist on buying expensive stocks that are running on fumes. People ask me every day about which stock will be the next Amazon or the next Google, or what the next disruptive technology will be.

It’s the billion-dollar question that everybody wants to know, and my research team has spent a great deal of time and resources looking into this. And interestingly enough, so have Amazon and Google, along with Microsoft and plenty of other huge corporations that want to stay on top of the tech game. They’re looking towards the technological innovation that’s going to dominate 2019 and, really, the next decade at least.

That technology is what’s known as machine learning, though you might know it as AI or artificial intelligence. Old-school computing technologies are being replaced with deep learning algorithms in which computers can actually mimic the human brain. Google, for example, recently acquired Onward, a customer service automation startup whose technologies enable computers to participate in natural, human conversations.

It’s a multibillion-dollar industry already, and the top analysts predict that AI monetization will grow by leaps and bounds:

Courtesy of Statista

It makes perfect sense for Google to invest in machine learning now, as this is a sector of the economy where the revenues will grow from $1.62 billion in 2018 to $31.2 billion in 2025, attaining a 52.59% CAGR during that period.

And Google isn’t the only firm spending billions to boost their machine-learning capacity: General Electric, for example, is building an AI workforce to monitor its aircraft engines, locomotives, and gas turbines and to predict failures with cloud-hosted software models of GE’s machines. For another example, media brands like USA Today, Hearst, and CBS are using AI to generate much of their content.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

AI has even developed to the point where it can identify and detect an object or feature in a digital image or video, and then compare it to a wide range of data sets to decide which ones are most relevant during image searches. This type of image-recognition technology is currently being used to detect license plates, diagnose diseases, analyze clients and their opinions, and verify users based on their face.

Courtesy of blog.adext.com

So, which company has the best prospects for strong returns in the AI space? The machine-learning company I’m seeing as the future of AI is Globalive Technology (TSX-V:LIVE, OTC:LVVEF), an industry-leading technology company focused on building software, including AI and blockchain technology.

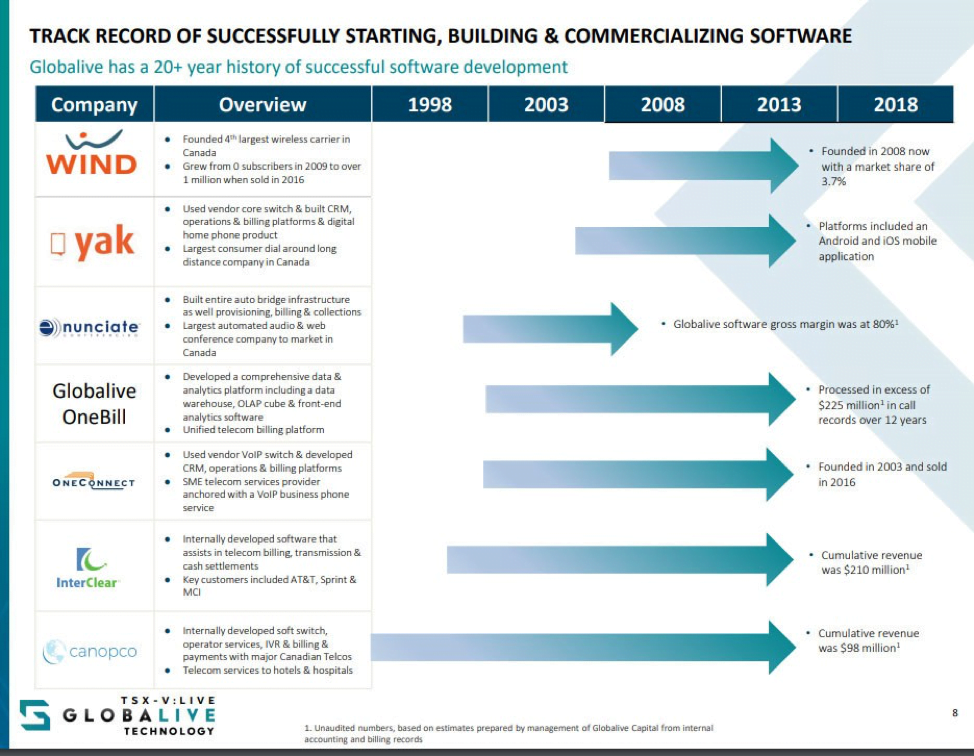

Founder and CEO Anthony Lacavera has had a stellar track record, such as when Wind Mobile, a company Anthony founded and controlled, was sold to Shaw Communications for $1.3 billion; and when the Globe and Mail named him CEO of the year in 2010. His team’s 20-plus-year history of successful software development make Globalive a sure bet to dominate the AI space in 2019:

Courtesy of Globalive Investor Presentation

Mr. Lacavera has also smartly focused Globalive on developing joint ventures with carefully selected high-growth companies to co-create and deploy AI-focused blockchain-enabled technologies. By partnering with companies which are in line with their business philosophy, Globalive is able to leverage the strengths of these companies without having to build the infrastructure and customer base from scratch.

Examples of these strategic partnerships include Globalive’s collaboration with CivicConnect to develop blockchain technology that will improve efficiency and sustainability while providing people the tools they need to more easily navigate their cities; as well as the partnership with Flexiti Financial, a top financial technology company, to develop blockchain and AI technology for credit cards including fraud, loyalty, and credit adjudication.

Crush the Street is super-bullish on the AI movement and on Globalive Technology as an investment to make right now. With Globalive in my portfolio, I’m looking forward to big gains as machine learning absolutely dominates the tech industry in 2019.

Prosperous Regards,

Kenneth Ameduri

Chief Editor, CrushTheStreet.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Legal Notice:

This work is based on public filings, current events, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.

The ideas, projections and views expressed are those of CrushTheStreet.com and are not ideas, views or recommendations of Globalive or any of its officers or directors. Any forward looking statements are based on our assumptions, projections, beliefs and expectations, however, there is no guarantee that these statements will prove to be correct and are subject to risks and uncertainties.

This work refers to joint ventures or investments that Globalive is a party to. Some of the joint ventures may be subject to further negotiation or documentation.

Never base any decision off of our emails. CrushTheStreet.com stock profiles are intended to be stock ideas, NOT recommendations. The ideas we present are high risk and you can lose your entire investment, we are not stock pickers, market timers, investment advisers, and you should not base any investment decision off our website, emails, videos, or anything we publish. Please do your own research before investing. It is crucial that you at least look at current public filings and read the latest press releases. Information contained in this profile was extracted from current documents filed with the public, the company web site and other publicly available sources deemed reliable. Never base any investment decision from information contained in our website or emails or any or our publications. Our report is not intended to be, nor should it be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell securities, or as a recommendation to purchase anything. This publication may provide the addresses or contain hyperlinks to websites; we disclaim any responsibility for the content of any such other websites. We have entered into a three year agreement directly with the company. We plan to purchase shares on the open market as a long-term holding, we have also been compensated eight hundred thousand dollars, eight hundred thousand options, and been given one million nine hundred thousand RSUs. Please use our site as a place to get ideas. Enjoy our videos and news analysis, but never make an investment decision off of anything we say. Please review our entire disclaimer at CrushTheStreet.com.