Jim Cobb, the author of Preppers’ Long-Term Survival Guide and Urban Emergency Survival Plan, once wrote, “Don’t worry about what you don’t know. Worry about what you can control.” This is great advice to follow in your home and in your investment portfolio.

Being a prepper isn’t about hiding from the world. It’s about being prepared for what’s coming before it happens. In your financial holdings, it’s okay to hope for the best of times, but you need to be ready for the worst of times.

We’re in a notoriously volatile month for equities, October, plus we’re in a highly contentious election cycle that could drag on well past November 3. Is your portfolio properly shielded from the storm that’s coming?

Beyond a position in precious metals and mining stocks (which I always recommend), here are five prepper stocks representing financially solid companies that should prosper when the you-know-what hits the fan.

Campbell Soup (CPB): This is an all-weather holding in the consumer staples sector. Canned goods are a must-have for survivalists because food is a necessity and canned food doesn’t perish quickly.

Courtesy: Cambpell Soup Co.

Besides, you’ll get a good value with CPB stock. Currently it has a price-to-earnings ratio of just 9.13. This indicates that the stock’s price is justified by the company’s profits, so it’s not overvalued.

And if you plan to hunker down and hold CPB stock for a while, you’ll collect annual dividends of almost 3%. That’s a nice little bonus for a tried-and-true safety stock that’s held up relatively well during multiple recessionary periods.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

Clorox (CLX): I know what you’re thinking: Clorox is all about bleach. And yes, Clorox is known for selling bleach and other antiseptic products, which proved to be quite popular during the onset of the coronavirus.

Courtesy: Clorox

Yet, there’s more to Clorox than bleach. What you might not know is that Brita water filtration products are marketed in the Americas by Clorox. So actually, I wasn’t even thinking about bleach when I put CLX stock on this list.

Food products won’t be enough for preppers because water is also a necessity. In a doomsday scenario and even in more peaceful times, you probably don’t want to rely on unfiltered municipal water. Therefore, it’s a good idea to take a stake in a stock with a clean-water connection, and CLX stock falls nicely into that category.

American Outdoor Brands (AOUT): This company’s name might not immediately ring a bell. However, if you visit the company’s brands page, you’ll see some prepper-friendly names, including firearm brand Smith & Wesson.

You’ll also see a wide variety of gear and accessories for rugged outdoor enthusiasts. These include hunting, fishing, camping, shooting, and personal security and defense products – plenty of products for skilled survivalists.

Prospective investors should also know that American Outdoor Brands beat Wall Street’s estimates on both earnings and revenues during its most recent fiscal quarter. Not only that, but the company’s quarterly revenues increased by an eye-opening 51.9%. Clearly, this is a great time to add AOUT stock to your prepper watch list.

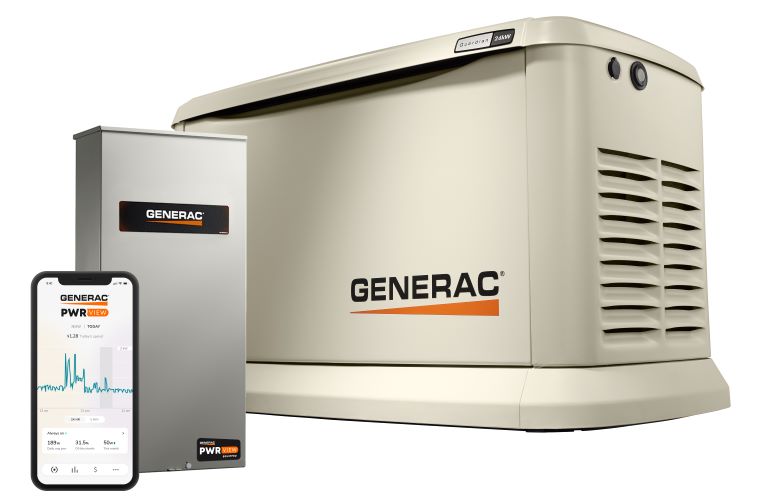

Generac Holdings (GNRC): It’s funny how so many people don’t think about owning a generator until the electricity goes out. For folks who would rather think ahead instead of panic when the lights go out, there’s generator manufacturer Generac Holdings.

And these aren’t the rinky-dink little generators that will power a small refrigerator for an hour or two. Generac Holdings sells top-of-the-line generators with all of the bells and whistles: Wi-Fi, a remote monitoring system, a mobile app – suffice it to say that this isn’t your grandfather’s generator.

Courtesy: Generac

Come to think of it, it’s not a terrible idea to own one of these generators while also investing in the company. GNRC stock has been absolutely crushing it in 2020, and I expect continued capital inflows into the generator manufacturing niche in general, and Generac Holdings in particular.

ADT Inc. (ADT): And lastly, don’t leave home security off of your prepper checklist. The company ADT was founded way back in 1874, believe it or not, and it’s been a go-to source for home security enthusiasts for as long as I can remember.

Just because ADT is an old company doesn’t mean that it’s behind the times. In fact, ADT recently rolled out ADT Blue, a comprehensive “smart” home security system. Controlled by the Blue app, this system offers live streaming, video recording, system arming/disarming, and 24/7 event alerts.

Looking at the stock, ADT provides an annual dividend yield of 1.71%, and every cash distribution is helpful when you’re preparing for the worst. Since home security is essential during times of crisis, you might consider adding an extra layer of safety to your portfolio with ADT stock.

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Disclaimer/Disclosure:

Legal Notice: No matter how good an investment sounds, and no mater who is selling it, make sure you’re dealing with a registered investment professional. Use the free, simple search at investor.gov

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEC filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at CrushTheStreet.com/disclaimer