The idea of Fed Chairman Jerome Powell cutting U.S. Treasury interest yields was unthinkable only a few months ago, when four rate hikes for 2019 were projected late last year. The 180-degree turnaround since then has been nothing short of remarkable, with interest rate hikes now off the table and rate cuts not just possible, but probable.

Sure, the latest FOMC dot plot projected no rate hikes in 2019, one rate hike in 2020, and no rate hikes in 2021. This might give the illusion that there won’t be any interest rate cuts, but we have to bear in mind that the dot plot isn’t written in stone and the Fed is by no means held to its projections.

Holding the Federal Reserve to its projections would be like holding a politician to his/her promises: a surefire formula for disappointment and, as an investor, capital loss. When interpreting FOMC projections, it’s much better to analyze the “spirit” of the dot plots than the numbers themselves.

More importantly, it’s better to judge the Fed by what they do, not what they say. No Fed committee or chairperson wants to be held responsible for a global recession, and with the “no more rate hikes” ammunition all used up now, rate cuts will be the only tool left in their well-worn toolbox going forward.

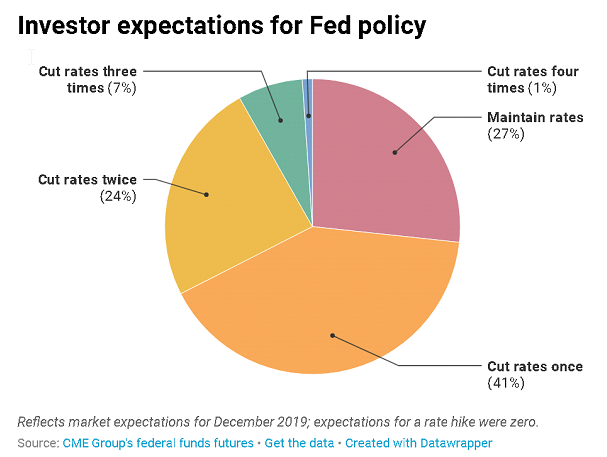

I’m not alone in this assessment, as nearly three-fourths of investors are preparing for at least one rate cut:

Courtesy: CME Group, cnbc.com

I’m not in the camp that’s projecting four Treasury interest rate raises this year; that would be overkill, even for a Fed committee that’s scared and backed into a corner. Still, with the Fed themselves admitting that global growth is slowing, I concur with the majority’s consensus that Jay Powell has every incentive to slash bond yields at least once this year.

Stephen Moore, about whom President Trump said last week that he will nominate for a Fed governorship, has directly stated that thinks the central bank should cut interest rates by half a percentage point. And so, when he joins the Fed, he’ll be the first member to openly advocate for an aggressive rate cut.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

Interestingly, Moore wrote in a December blog post that Jerome Powell should “do the honorable thing … and resign.” Now, Moore’s saying, “I think Powell’s doing the best job that he can.” Backpedal much?

Okay, I’ll go easy on the guy – we all have to “go along to get along” whenever we get a new job. Still, I’m uncomfortable with Moore leading the charge for QE 4, 5, 6… whatever, I’ll just call it QE Infinity. Call it what you will, but it’s not good for investors, retirees, savers, or the nation.

“But it’s been working for a decade…” Yes, I understand that the central bank market prop job has been effective so far, if we define “effective” as forcing everyone to pile into a risky stock market. But the Plunge Protection Team (yes, this team really does exist – more information on that here) can’t continue their magical levitation act forever, what with new yield curve flattening and inversions flashing on a daily basis and all:

Courtesy: FactSet, cnbc.com

The 10-year T-note yield is at 2.372% as I write this, and it’s lower than the 3-month yield, which is 2.443%. Let that sink in: loaning money to the U.S. government for 10 years will yield you smaller annualized interest payments than loaning money to them for 3 months.

I’ve already discussed how the real 10-year Treasury note yield isn’t actually 2.372%, and how after inflation is factored in, it’s more like zero. So in real terms, we’re already in NIRP territory and heading for ZIRP. And by the way, yields on the German 10-year bund and the Japanese 10-year are now negative, with Germany selling negative-yielding 10-year bunds for the first time since 2016.

So, America still has a ways to go before achieving true NIRP Nirvana, though we did get fairly close when Janet Yellen brought the 10-year Treasury yield to 1.38% in the summer of 2016. How long it will take for Jay Powell to produce subzero bond yields is anybody’s guess, but two things are fairly certain: the rate cuts will start soon enough, and the Plunge Protection Team will be working overtime this year.

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!