When buying just about anything else, consumers expect to get a decent “bang for their buck”: a return on investment that justifies the price tag. Yet somehow, the ROI for a college education hasn’t kept up with skyrocketing tuition costs – and more now than ever, Americans are simply opting out of higher ed.

When I was young, I bought into the notion that a bachelor’s degree is a guaranteed ticket to the middle class. More recently, I remember Hillary Clinton saying that people with college degrees will earn a million more dollars over their lifetime than people without a college education.

The next thing you know, I was teaching at small two-year colleges and was absolutely astounded at the tuition costs. A two-year health-care degree was around $40,000 and that was years ago, so of course it’s even more expensive now. There was no guarantee of a job after graduation, but the debt burden was guaranteed – and I have serious doubts that those graduates will earn an extra million dollars.

While the Federal Reserve is busy talking about letting inflation “run hot” and “play catch-up,” college tuition is running hotter than ever before. The only other expense that compares is health care, but at least it can be said that health care is a necessity; colleges must prove their value to the students, and they’re failing to do so.

Courtesy: Yahoo Finance

Over the past five years, the average cost of college tuition in America has exceeded the rate of inflation by 3.87%. This doesn’t factor in the other financial burdens typically associated with college, such as books and room and board. As you can see in the graphic above, some states are worse than others, with Montana showing a near-13% post-inflation price increase.

Not surprisingly, there’s been an inverse correlation between the price tag and college enrollment. As the cost of college courses goes through the roof, the ROI drops and prospective students determine that it’s simply not worth the investment. Plus, there’s an opportunity cost: those four or more years spent in college classrooms could instead be spent earning a salary and resume-enhancing occupational experience.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

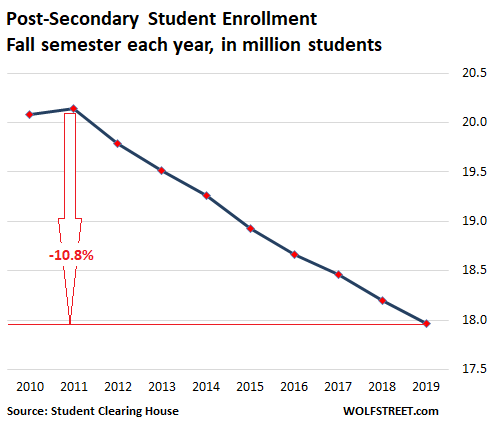

Doug Shapiro, the Executive Research Director at the National Student Clearinghouse Research Center, observes a rather shameful milestone recently reached in America: “With every institutional sector experiencing enrollment declines this fall, the higher education industry has now shed more than 2 million students since its peak in 2011 and the unduplicated count has fallen below 18 million for the first time.”

Courtesy: WolfStreet.com via ZeroHedge

Appallingly, enrollment since 2011 has declined by 10.8%, or 2.17 million students. During this same time horizon, student loan balances increased 74% from $940 billion to $1.64 trillion. Again, the inverse correlation is stark and telling.

The Obama administration practically ordered 18-year-olds to go to college, but selling an expensive, non-value-added service isn’t as simple as that; people need a reason to take on tens of thousands of dollars in debt. In a truly free market, consumers will choose what they perceive as valuable, and the chart above clearly indicates that college might not be worth the price of admission anymore.

I don’t see a solution in government intrusion or raising taxes, but in allowing capitalism to achieve its purpose: letting businesses thrive when customers choose them, and letting them wither and expire when people take their business elsewhere. And so, if colleges want to reverse the trend, they’ll need to find ways to adapt – if they don’t learn this lesson, soon school won’t be in session.

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!