If you’re in a camp that thinks we’re not in recessionary times, consider that people making six-figure incomes account for the most robust shift to Dollar General’s customer base, the food stamp program hit record costs last year, consumers are taking on a record amount of credit card debt, the U.S. housing market is getting pummeled as home sales slumped to a 12-year low, the Leading Economic Index has seen economic activity tumble for 10 straight months with a widespread weakening outlook for manufacturing, homebuilding, and both job and financial markets, 41% of all small business owners could not pay rent obligations in 4Q22, plebes are falling behind on car payments at a higher rate than 2009 and repossessions are spiking, over half of the 50 U.S. states are showing signs of slowing economic activity, ex-Fed chief Greenspan said a recession is the most likely outcome, Moody’s warned that we’re in for a “slowcession” that may last all year, the economy is the most unloved on record in a recent survey of economists, both ISM and PMI sides of the economy slumped into contraction with factory orders plunging the most since the COVID panic, global PC shipments crashed 29% YoY in 4Q22 while smartphone shipments had their largest-ever 18.3% decline along with other consumer electronics, the busiest U.S. shipping port went from swamped to a dormant volcano, and holiday retail sales tanked in 2022 despite the hopium from financial rags and armchair analysts in the social media sphere.

Michael Burry was portrayed in “The Big Short”

“Fascinating how on the same day that the index of leading economic indicators slid 1.0% in December (consensus was -0.7%), making it ten down months in a row which is a sure-fire recession harbinger, that the ‘soft landing’ narrative has gained the upper hand.” – David Rosenberg, Jan. 23

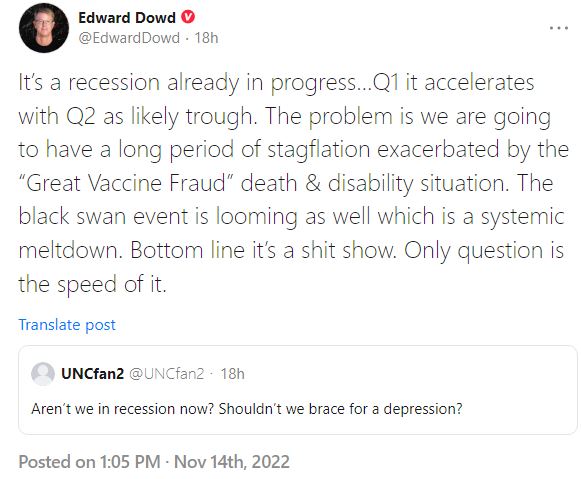

I recommend that readers first peruse Lacy Hunt’s Hoisington Management 4Q22 Review and Outlook published in mid-January 2023, then review the full transcript and selected charts from Mish Shedlock’s phone interview with Lacy last week in “A Better Definition of Money and Lacy Hunt’s Thoughts on When a Recession Will Start.” The following excerpts are from Mish’s interview and “Welcome to the Most Anticipated Recession in History Part 3” from November that included an astute observation by Edward Dowd:

- Lacy to Me: When do you think recession started?

- Mish: November or December.

- Lacy: I think it started in November.

- Mish: Can I quote you?

- Lacy: OK Go ahead.

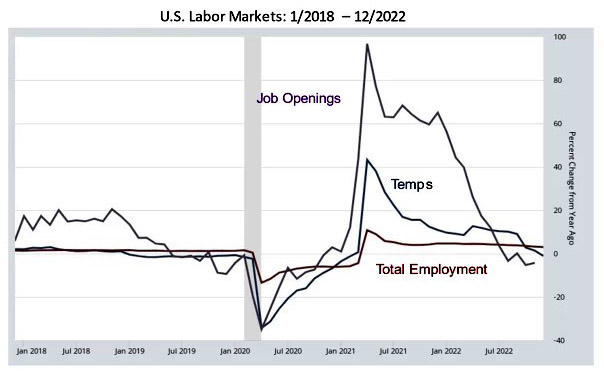

“I thought [the] recession started in May, but incoming data proved me wrong. Right now, the primary strength left in the economy is a reduction in consumer demand for goods. That reduction in demand reduced the trade deficit and thus added to GDP… Some cite jobs as a strength but Lacy noted the declining work week… Lacy and I also discussed Industrial Production. Why is IP signaling recession? Because peaks in industrial production coincide with recessions. Recession lead times vs industrial production tend to be very small, typically 1-2 months. 2001 and 2020 were notable exceptions… Industrial production appears to have peaked, real retail sales are declining, full time employment has been falling, and there is a huge discrepancy between the household and payroll surveys.” – Mish Shedlock, Jan. 23

“Predicting when the financial lords of officialdom will recognize it and legacy media headlines will report it is a futile exercise among plebes as their home equity, retirement accounts, and savings are steaming away like frogs slowly boiling. The FOMC membership has begun to telegraph that a slower pace in rate hikes is on the table, but what level the Fed Funds Rate (FFR) will reach before the hiking of interest rates comes to an end is a crapshoot. Prior to and after the November FOMC meeting, numerous cracks appeared in Biden’s and Powell’s narrative that the United States economy was on strong footing.” – TraderStef, Nov. 14

Starwood Capital CEO Barry Sternlicht weighed in last week with a surprise chunk of commentary for CNBC anchors about ongoing risks in the global economy.

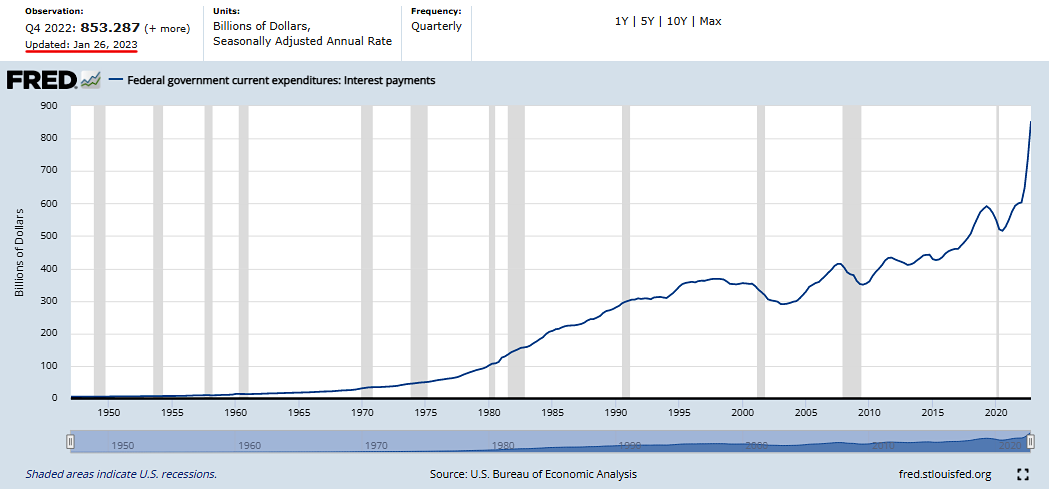

“If Powell keeps hiking rates, you have the Weimar Republic. He has to keep printing dollars to pay interest on the deficit. That will really slow the economy. He risks the entire financial stability of the global economic system.” – CNBC Video

It was emphasized in “Gold and Silver Outlook for Winter 2023 Part 2” published on Jan. 14 that the U.S. national debt was at $31.5 trillion and interest payments to service that debt is approaching $1 trillion annually. “That’s not sustainable with the Federal Reserve’s current quantitative tightening (QT) and the hiking of interest rates.” Then there’s the hidden $65 trillion of foreign-exchange derivative liabilities on the balance sheets of non-U.S. banks and shadow banks that’s 2.5x the size of the entire U.S. Treasury market that could implode without notice. Meanwhile, our honorable Capitol Hill critters are engaged in partisan warfare with stark differences that must be reconciled over a debt ceiling increase before June, which may result in another U.S. credit rating downgrade on the way or end in a government shutdown and technical debt default. As of last week, interest on the debt is $853+ billion. Note that spike during 2022 as the FFR was hiked aggressively at every meeting since last March. The #TaperCaper is alive and well.

Chart Courtesy of FRED – Jan. 26, 2023

It’s not just the U.S. in trouble, as Europe’s ECB backed itself into a monetary policy quagmire with economic blowback from implementing economic sanctions on Russia over the war in Ukraine.

“The risk of over-tightening by the European Central Bank is nothing less than catastrophic… Italy is extremely vulnerable. But this could pop anywhere. Global debt has gone up massively since the pandemic: public debt, corporate debt, everything… We were very fortunate that we didn’t have a global systemic event in 2022, and we can count our blessings for that, but rates are still going higher and the risk keeps rising.” – Professor Kenneth Rogoff of Harvard at Davos, Gold Switzerland

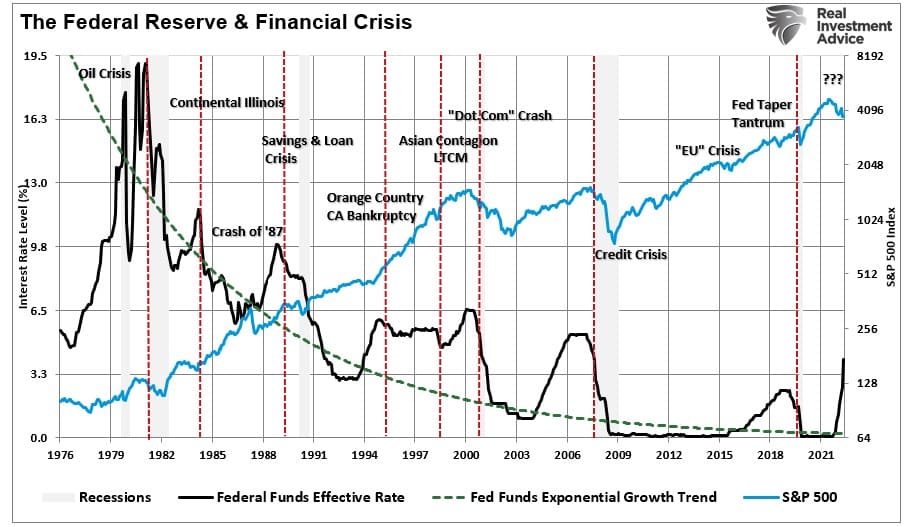

“The Fed has never entered into a rate hiking campaign with a ‘positive outcome.’ Instead, every previous adventure to control economic outcomes resulted in a recession, bear market, or some ‘event’ that required a reversal of monetary policy.” – Lance Roberts

Courtesy of Lance Roberts at RIA

The Goldilocks job market is not as great as you’re led to believe since an enormous number of layoffs will eventually inflate the unemployment soup line after gracious severance packages run dry.

Chart Courtesy of Layoffs Tracker

Is that Goldilocks or the three recessionary bears coming home?… “When the Fed figuratively hits the brakes, credit tightens, lending heads south, and growth in bank deposits turns pale. Consumers cut back on spending, and employers stop hiring as many workers. Less money is chasing the same goods, and inflation falls. How this relates to employment is shown in the following chart… Yes, Goldilocks may still have a chance, but it is a slim one.” – Washington Examiner, Jan. 13

Where Did All the Workers Go?… “To overgeneralize: In 2020, the vulnerable died of Covid at unusually high rates. In 2021 and 2022, Covid continued its assault, but the young, middle-aged, and healthy also died in aberrantly high numbers of something else (the jab). These patterns are repeating across the high-income developed world – Germany, the UK, Japan, South Korea, Australia.” – Brownstone Institute, Jan. 20

NATO’s proxy war in Ukraine is an unpredictable wildcard on this poker table that will impact the world economy more so than it already has. If you’re not up to speed on the latest developments, read “The Surge of ‘Little Green Men,’ and Metal is Poised to Strike – Part XI” published on Jan. 21 (Twitter thread). Stay frosty out there and consider stacking some gold or silver coins while high premiums are subsiding.

Wardogs and the Global Economy – London Real with Jim Rickards, Jan. 15

Plan Your Trade, Trade Your Plan

TraderStef on Twitter, Gettr / Website: TraderStef.com